Guides

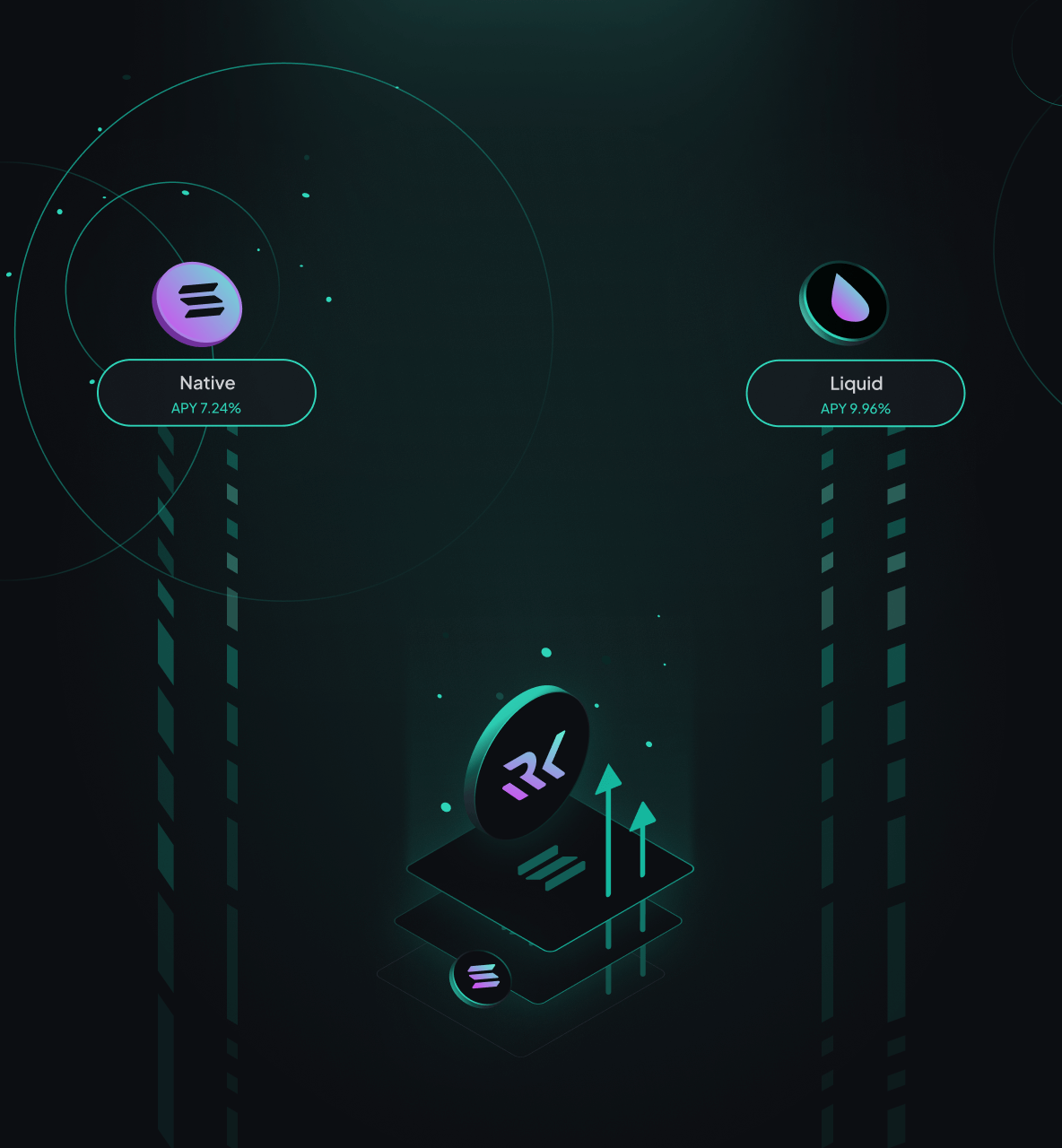

Liquid vs. Native Staking on the Solana Chain

Staking on Solana isn’t a binary decision anymore but one with structural dimensions.

Reading Time: 5 minutes

Staking on Solana isn’t a binary decision anymore but one with structural dimensions. This article breaks down the real-world implications of staking type across:

- Mechanics and custody: How delegation and control differ between native and liquid staking.

- Yield and liquidity: How APY, compounding, and exit dynamics shift with protocol abstraction.

- User alignment and risk posture: Which model fits your strategy, and what tradeoffs you’re underwriting.

If you’re ready to explore liquid staking, you can research and more on the app.

Why The Debate Exists

Staking on Solana used to mean one thing: delegate SOL to a validator, wait for rewards, and eventually unstake. But as protocol layers evolved, that simplicity fractured.

Liquid staking protocols now let users earn yield without giving up asset mobility, creating a structural shift in how staking decisions get made. Today, delegators aren’t just choosing validators; they’re choosing between architectural models of yield custody, liquidity access, and exposure management.

Liquid staking accounts for over 10-15% of all staked SOL, and that number is rising. Native staking is still the baseline, but it’s no longer the default. The criteria for staking selection is a tradeoff between control, liquidity, and abstraction.

Core Functional Differences: Liquid vs. Native Staking

Native and liquid staking differ not just in architecture, but in who holds custody, how validators are chosen, and whether unstaking requires delay or token swaps.

| Dimension | Native Staking | Liquid Staking |

|---|---|---|

| Delegation Method | Direct to validator via wallet or CLI. | Routed via protocol smart contract (e.g., Marinade, Jito). |

| Custody Model | Self-custodied SOL remains under wallet control (minus lockup window). | Protocol holds SOL; users receive liquid tokens (e.g., rkSOL). |

| Redemption Latency | ~<2 day unlock period per Solana protocol. | Immediate exit by swapping liquid token (subject to slippage/liquidity). |

| DeFi participation | Locked stake can’t be used as collateral or LP. | LSTs can enter DeFi protocols (Kamino Save, MarginFi, etc.) while still earning staking yield. |

| Revenue sharing | Today: yield = base inflation minus validator commission. Coming H2 2025: SIMD-0123 will let validators pass MEV/block-reward rebates to native stakers. | Many pools already route MEV or fee rebates to token holders, so current APY can exceed native staking (one driver of LST growth). |

Who Should Use What: Best-Fit Archetypes

Staking preferences aren’t driven by yield alone. Delegators weigh liquidity needs, validator control, and how much protocol risk they’re willing to accept. These four user types reflect distinct staking postures, not just different interface choices:

| Delegator Type | Goal | Risk Tolerance | Best Fit |

|---|---|---|---|

| Passive Delegator | Simplicity through major crypto exchange platforms | High. You don't own the wallet where the SOL is held, delegating custody into the exchange. High fee structure but still generating a low yield due to the exchange delegating into their own Validator being transparent for the user. | Own SOL in central exchanges, such as Coinbase. |

| Stake Pool Native Delegator | The lowest risk option, moderate yield and governance participation options. | Very Low. Delegation split across multiple Validators with medium yield. Increased decentralization, however with general lack of control over malicious Validators. | Native staking via stake pool websites, such as Marinade. |

| Stake Pool Liquid Stake Delegator | High DeFi presence and aligned with pool principles. | Low. Delegation split across multiple Validators, still exposed to smart contract risk. Increased decentralization, however with general lack of control over malicious Validators. | Acquiring the liquid token via exchanges or wallets, such as JitoSOL or mSOL. |

| Validator-Aligned and Native Staker | Delegates based on validator values (decentralization, infrastructure, project support, principles etc). | Low to Medium. Willing to adapt to validator mission. Susceptible to changes in fees structures or uptime, it requires further attention. | Native staking with self-selected validators through Wallet interface or Validator websites such as Starke Finance. |

| Validator-Aligned and Liquid Staker | Delegates based on validator values or highest yields among all options. Also participating in DeFi. | Low to Medium. Willing to adapt to validator mission and exposed to smart contract. Susceptible to changes in fees structures or uptime which require further attention. | Acquiring the liquid token via exchanges or wallets of your choice, such as rkSOL. |

Yield Dynamics and Slippage

Native staking delivers baseline yield via validator rewards and inflation participation. Liquid staking adds protocol-layer enhancements, which change both expected returns and exposure pathways. Here’s how it breaks down:

| Dimension | Impact |

|---|---|

| MEV Capture | Protocols like Jito add MEV income to standard validator rewards, often raising APY by 1–3%. |

| Protocol Fees | LSTs usually charge a small cut (e.g., 0.5–1%) on yield for liquidity and management. |

| Compounding | Native stakers must wait a day to just under two days between epochs. Liquid protocols auto-compound, reducing idle time between epochs. |

What Happens When You Move Positions:

Unstaking native SOL: <2-day unlock. No slippage. Full control.

Selling rkSOL: Instant via swap, but may incur 0.3–1% slippage depending on liquidity depth.

Validator underperformance: Native APY suffers.

Unstaking Experience

Exiting a staking position looks very different depending on whether you're using native or liquid staking.

Native SOL

- Requires a 2-day, or slightly less, unlock period.

- No slippage.

- Full validator voting rights retained until exit.

Liquid Staked Tokens (e.g., mSOL, JitoSOL)

- Can be sold instantly via AMMs or CEXs.

- Subject to market slippage, especially in low-liquidity windows.

Using LSTs in DeFi introduces new surface risks: collateral sensitivity, mispriced oracles, and liquidity gaps during native redemptions.

Risk Dimensions

Every staking mechanism embeds risk, but the source and surface of that risk changes drastically between native and liquid models. Here’s how those exposures map out:

| Issue | Mitigation |

|---|---|

| Smart contract exposure — Liquid staking requires custody handoff to smart contracts. If exploited or misconfigured, assets may be drained or locked. | Use audited, upgrade-transparent protocols with known exploit history and active security disclosures. Native staking avoids this vector. |

| Opaque validator routing — Stake pools select validators internally. Delegators lose control and may unintentionally centralize stake. | Choose protocols with published validator sets and transparent delegation rules. |

| Loss of delegation intent — Stake pool users can’t signal alignment with specific validators (e.g., geography, decentralization). | Use native staking when validator-level values matter. Use single validators if needed. |

The Wider View: Staking Infrastructure

Stake-allocation algorithms, whether in native stake-pools or liquid-staking protocols, are reshaping validator economics. Routing contracts such as Jito and Marinade now channel billions in SOL based on a few selection rules. For many smaller validators, that redirected stake is the only way to cover rising hardware and consensus-vote costs. By contrast, brand-recognised, self-funded validators that already draw institutional or ecosystem stake stay largely independent but also face slower growth because stake is notoriously sticky.

Broader Developments

Stake consolidation: The largest pools still steer a disproportionate share to the top 10–20 validators, making it hard for new entrants to break in.

MEV stratification: With Jito’s block engine effectively the sole MEV venue, searcher fees flow to validators inside its set, widening the revenue gap.

On-ramp friction: High hardware specs and vote-transaction costs keep the barrier to entry high. The Solana Foundation roadmap includes lower spec targets and lighter consensus roles to ease that pressure.

The result is an increasingly tiered validator landscape in which joining, or at least being visible to, the liquid-staking stack matters almost as much as raw uptime. Upcoming protocol changes aim to reopen that door for new, independent operators.

Wrapping Up

Direct native delegation lets you hand-pick validators and lock stake during the cool-down. Native stake-pools sit between direct and liquid options: they spread native stake across multiple validators without minting a new token, keeping the same unlock schedule while simplifying diversification. Liquid-staking protocols mint an LST, such as rkSOL, so you can trade or deploy your stake in DeFi immediately, at the cost of added smart-contract and redemption-depth risk.

The infrastructure is evolving quickly, so match the path to your liquidity needs and risk appetite to turn staking from passive exposure into an intentional yield strategy.

Ready to Commit Capital with Intent?

Open the Starke Finance app to start staking—natively, if you value validator alignment, or via liquid protocols, if you need mobility and yield routing. The interface surfaces both paths, but the decision remains yours.

Contributors

Linh NguyenCommunication Manager