Research

Weekly Market Recap - November 30, 2025

Global markets gained this week despite mixed macro data, while crypto saw a selective rebound with rising market cap, stablecoin stability, and continued momentum in tokenized assets and regulatory developments.

Download the PDF

Estimated Reading Time: 16 minutes

Summary

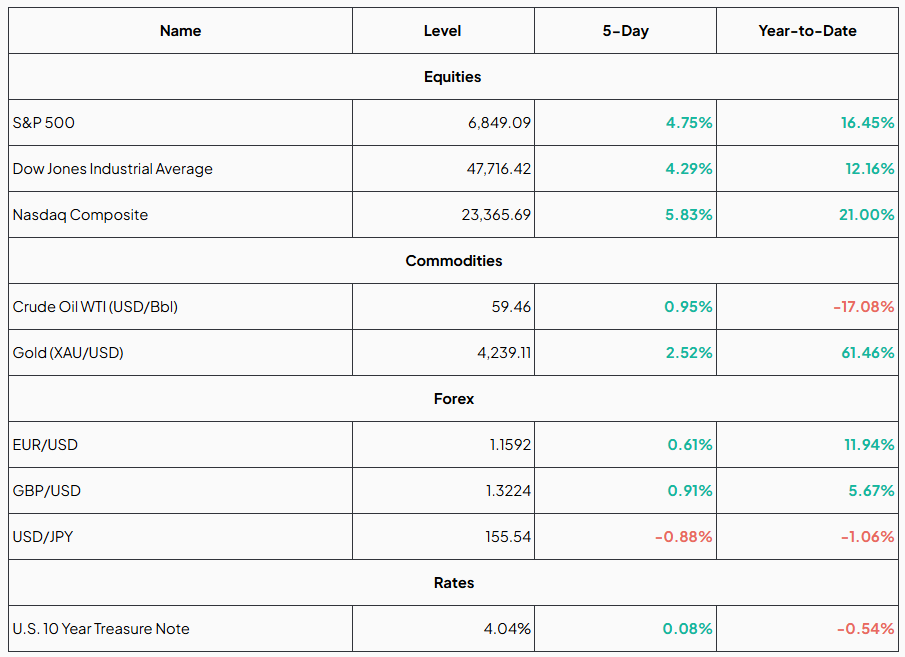

Markets strengthened last week as improving risk sentiment lifted major U.S. equity indexes, with the S&P 500, Dow, and Nasdaq all posting firm gains. Commodities moved unevenly, WTI crude stabilized while gold extended its strong performance on softer real yields and a weaker dollar. FX markets mirrored this tone, with the dollar declining broadly. Global macro data, however, offered a more nuanced picture: in the euro area, Germany's business sentiment deteriorated and Q3 GDP stalled, reinforcing concerns about the region's sluggish momentum; in the United States, economic indicators were mixed, with wholesale inflation firming even as retail spending slowed and consumer confidence fell to a seven-month low; and in China, PMIs declined across manufacturing and services, signaling a renewed loss of economic traction.

Crypto markets showed a cautiously constructive tone, with total market capitalization rising 6.5% despite uneven performance among major assets. Bitcoin fell slightly and continued to lose market share as flows rotated toward mid-cap and higher-beta names, while Ethereum posted a modest gain but remained negative year-to-date. Large altcoins such as Solana, BNB, Dogecoin, and Cardano mostly declined, signaling persistent caution, while assets like TRON and Bitcoin Cash offered pockets of relative resilience.

Stablecoins and tokenized real-world assets (RWA) provided stability across digital markets. Stablecoin capitalization held near $306 billion, with USDT dominance increasing and Solana-based stablecoins seeing notable growth. RWAs grew 0.8% to about $36.1 billion, supported by gains in tokenized commodities, equities, and private credit, even as some treasury-focused and actively managed products experienced moderate outflows. Overall, these segments continued to anchor liquidity and institutional adoption despite the selective risk appetite.

Regulation and infrastructure development accelerated meaningfully. Multiple crypto ETFs advanced, including Franklin Templeton's XRPZ, Grayscale's GDOG, and Bitwise's BWOW, while Nasdaq moved to expand IBIT option limits and Texas initiated the first U.S. state-level Bitcoin reserve. Major tokenization milestones included Securitize gaining EU approval to operate on Avalanche and Amundi launching a tokenized euro money-market share class on Ethereum. Globally, Uzbekistan prepared to legalize stablecoin payments, the UK announced mandatory reporting of all crypto transactions starting in 2026, and platforms like Crypto.com, Kraken, and Binance expanded real-world payment and tokenized-equity capabilities, underscoring rapid integration of digital assets into mainstream finance.

Market Confidence and Adoption

Broad Markets

Global markets posted a broadly positive performance this week, with risk sentiment improving as investors responded to rising market expectations of future Federal Reserve rate cuts, even as policymakers maintained a cautious tone. U.S. equities rallied sharply, supported by renewed enthusiasm for growth sectors and a rebound in cyclical names, while commodity and currency markets reflected a shifting macroeconomic backdrop driven by a softer U.S. dollar and evolving global demand dynamics.

U.S. equity indexes advanced strongly across the board. The S&P 500 surged 4.75% over the past five days, while the Dow Jones Industrial Average gained 4.29%, aided by strength in industrials, financials, and other economically sensitive segments. The Nasdaq Composite outperformed, rising 5.83%, as investors rotated back into high-growth and technology shares following a pullback earlier in the month. Market sentiment improved meaningfully as traders priced in a higher probability of a Fed policy pivot, though analysts noted that large-cap growth names continued to drive the bulk of the gains, reinforcing concerns about narrow market breadth.

Commodity markets moved in divergent directions. Crude oil (WTI) edged up 0.95%, finding modest support as inventories tightened slightly and speculative positioning stabilized, even as broader concerns about global industrial demand persisted. Gold rose 2.52%, extending its impressive year-to-date run. The metal benefited from falling real yields, a softer dollar, and renewed safe-haven interest amid persistent geopolitical uncertainty and shifting rate-cut expectations.

In foreign exchange, the U.S. dollar weakened as markets increasingly anticipated a less restrictive Federal Reserve stance in the coming months. The euro advanced 0.61%, supported by the dollar's decline rather than domestic European data, while the British pound strengthened 0.91% on the week as risk sentiment improved. The Japanese yen appreciated modestly, with USD/JPY falling 0.88%, reflecting reduced rate-differential pressure as U.S. Treasury yields eased from recent highs.

Treasury markets were mostly steady, with the U.S. 10-Year Treasury yield inching up 0.08 percentage points to 4.04%. The slight move higher came as global yields firmed and bond investors balanced easing inflation indicators against uncertainty surrounding the timing and magnitude of potential Fed rate cuts. The restrained action in rates markets underscores prevailing caution, as investors await further clarity from upcoming macroeconomic data and central bank communications.

Weekly Market Data

Source: MarketWatch.com , Google Finance, TradingView (As of November 30, 2025)

Cryptocurrencies

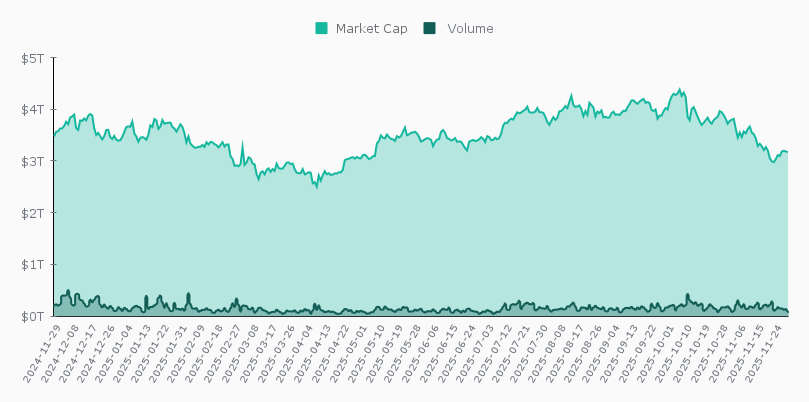

The cryptocurrency market delivered a constructive week, with total market capitalization rising 6.5% as investors cautiously re-engaged following recent weakness. Trading activity reflected a measured return of risk appetite, supported by improving macro sentiment and growing expectations for a more accommodative policy stance. Market cap advanced steadily across several sessions, and a mid-week uptick in volumes pointed to active repositioning rather than passive drift, with participants selectively rebuilding exposure across the digital-asset landscape.

Toward the end of the week, conditions stabilized as volumes eased and price movements moderated. This consolidation appeared more like a pause to absorb gains than the start of a reversal, with prices holding firm despite lighter activity. Overall, the tone suggested a market regaining confidence, though still waiting for clearer macro catalysts before committing to a broader directional shift.

Crypto Market Capitalization and Volume

Source: CoinGecko.com

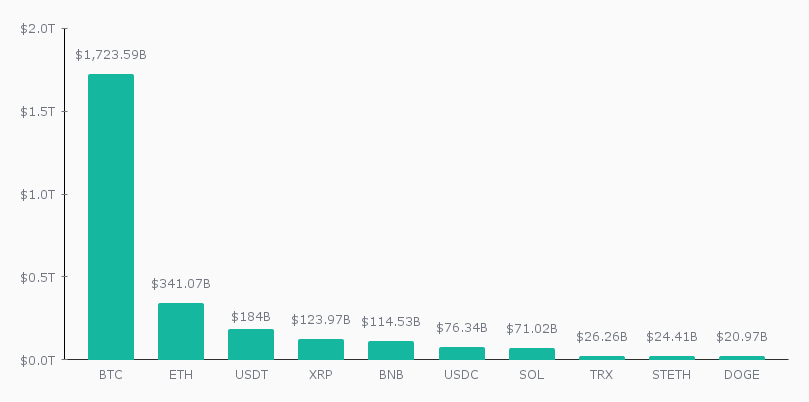

Within this broader recovery, performance among major assets remained uneven. Even as total market cap increased, many of the largest cryptocurrencies declined, leading to modest adjustments in market share as capital shifted toward smaller, higher-beta assets. Bitcoin's market cap fell by $9.6 billion, and its dominance moved from 58.2% to 57%, signaling that it lagged the broader recovery as investors explored opportunities in faster-moving segments. Ethereum saw a slight increase in market cap while its market share held essentially flat, reinforcing the view that mid-cap names, not the major platforms, contributed most to the week's gains.

Stablecoins showed mixed dynamics. USDT recorded a small decline in both market cap and dominance, whereas USDC grew by roughly $2.1 billion and gained fractional market share. This divergence reflects routine liquidity reallocations rather than a directional shift in sentiment, as capital moved selectively between stable-value instruments.

Most leading altcoins, including BNB, Solana, and Dogecoin, registered declines and slipped slightly in market share, highlighting lingering caution toward large-cap altcoins. TRON and Lido Staked Ether were among the few that posted modest gains, though their influence on overall market structure remained limited.

In summary, optimism returned selectively, with total market capitalization expanding even as major assets remained stable but subdued. Leadership continued to come from outside the largest coins, pointing to a market rebuilding confidence gradually while positioning ahead of the next macro driver.

Cryptocurrency Market Share

Source: CoinGecko.com (As of November 30, 2025)

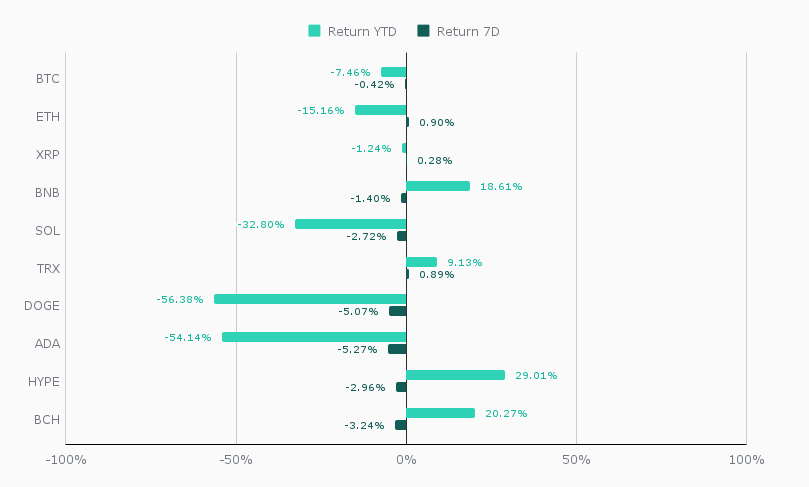

The same cautious undertone could be seen in weekly price performance. Bitcoin slipped 0.4% to $86,459, extending its year-to-date decline to -7.5%, as institutional outflows and risk-off pressure kept the largest asset contained. Ethereum gained 0.9% to $2,828, though it remains down 15.2% year-to-date, reflecting ongoing hesitation toward large-cap altcoins that continue to struggle against technical resistance.

Other major tokens showed similarly mixed behavior. XRP rose 0.3% but remains slightly negative for the year. BNB declined 1.4% despite maintaining a strong 18.6% YTD gain, while Solana fell 2.7%, further deepening its -32.8% year-to-date losses amid persistent volatility and liquidity pressures. These moves mirror commentary highlighting that large altcoins remain vulnerable to de-leveraging and tighter market conditions.

Speculative and sentiment-driven assets fared worse. Dogecoin dropped 5.1%, extending its -56.4% YTD slide, while Cardano fell 5.3%, leaving it down -54.1% for the year. These declines reflect continued rotation away from higher-risk tokens as traders trim exposure to the most volatile parts of the market.

There were, however, a few relative bright spots. TRON gained 0.9% for the week and remains up 9.1% year-to-date, supported by its steadier profile. Hyperliquid slipped 3% but still holds a strong 29% YTD gain, while Bitcoin Cash fell 3.2% yet maintains a solid 20.3% rise for the year, evidence that selective pockets of resilience persist even as broader conditions remain cautious.

Overall, the week underscored a market still navigating uncertainty, with most major assets posting mild to moderate declines amid cautious sentiment and uneven participation. Strength was concentrated in only a few names, while high-beta and speculative tokens absorbed much of the selling pressure. With macro conditions still shaping risk appetite and investors selective in their positioning, the asset class appears to be consolidating and waiting for clearer catalysts to determine its next direction.

Weekly Return of the Top 10 Cryptocurrencies by Market Capitalization (excluding Stablecoins)

Source: TradingView.com (As of November 30, 2025)

Stablecoins

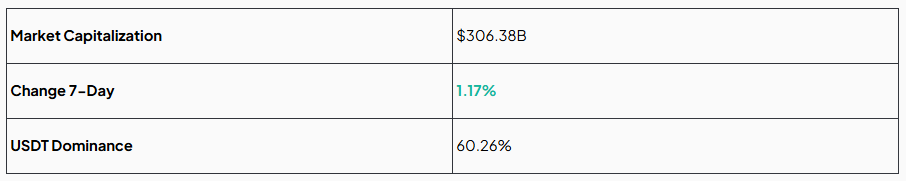

The stablecoin market was broadly steady this week, with total market capitalization hovering around $306.38 billion, marking a modest 1.17% increase over the past seven days. This stability stands in contrast to the more volatile movements seen across major cryptocurrencies, underscoring the continued role of stablecoins as a liquidity anchor during periods of shifting market sentiment. The limited changes suggest that investors neither aggressively exited nor flooded into stablecoins, instead maintaining a balanced position while awaiting clearer macro signals.

USDT strengthened its dominance, rising to 60.3%, as its large and persistent supply continued to serve as the ecosystem's primary source of transactional liquidity. Ethereum-based stablecoins held firm at $166.52 billion, up 1%, reflecting steady DeFi activity and sustained usage across payments, lending, and liquidity provisioning. TRON-issued stablecoins saw a smaller 0.7% increase to $79.36 billion, consistent with the network's continued strength in high-frequency, low-cost transfers. Solana-based stablecoins posted the strongest percentage gain this week, rising 11.5% to $14.49 billion, suggesting renewed momentum in Solana's ecosystem despite broader market caution.

In essence, despite mixed dynamics across individual networks, the stablecoin sector remained one of the market's most stable corners this week. Incremental growth across major chains signals continued functional demand, while the absence of significant outflows highlights investor preference to keep liquidity on-chain as broader crypto valuations consolidate.

Key Metrics

Source: DefiLlama.com (As of November 30, 2025)

Tokenized Real-World Assets (RWA)

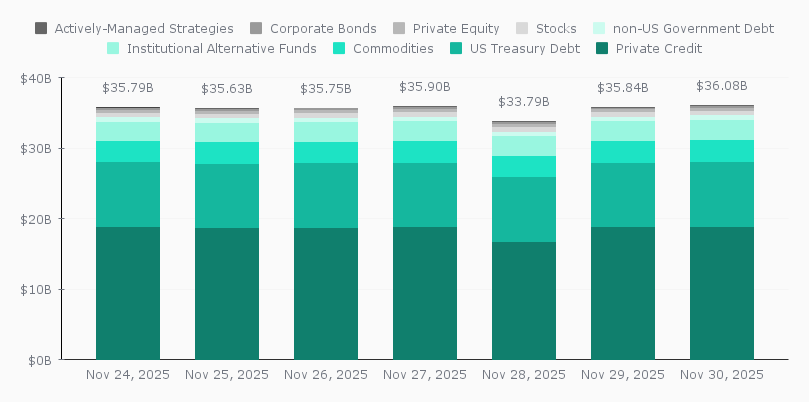

Between November 23 and November 30, 2025, the total value of tokenized real-world assets on-chain posted a modest 0.81% increase, signaling a week of generally steady but uneven flows across categories. While the aggregate market value rose to $36.08 billion, the underlying components reflected a mixed picture of investor positioning, platform activity, and shifts in tokenization demand.

Private credit, the largest segment of the RWA landscape, recorded a 1% increase, climbing back above $18.8 billion after a temporary dip earlier in the week. The rebound suggests continued institutional engagement with on-chain lending structures, even as cyclical adjustments and repayments periodically influence outstanding tokenized balances. Tokenized U.S. Treasury exposure remained broadly stable, rising 0.1%, consistent with the low-volatility profile and steady demand that typically characterize government debt instruments on-chain.

Other categories experienced more pronounced momentum. Tokenized commodities grew 4.1%, reflecting firm investor appetite for digital representations of physical assets, particularly during periods of macro uncertainty. The strongest expansions occurred in tokenized stocks and private equity, which rose 8.5% and 9.2%, respectively. These gains point toward renewed interest in tokenized equity-like exposures, potentially driven by broader market recoveries or increased activity from tokenization platforms bringing new assets on-chain.

Not all areas advanced. Institutional alternative funds fell 3.5%, continuing a gradual cooling trend observed in recent weeks. The decline may reflect portfolio rebalancing, profit-taking, or a reduction in the number of actively tokenized fund structures. Actively managed strategies saw the most significant pullback, dropping 11.8%, suggesting a contraction in strategy issuance or decreased participation in more complex, discretionary products. Corporate bonds, by contrast, were relatively stable, posting a slight 0.3% increase, consistent with the steady, income-oriented profile of this category.

Overall, the week highlighted a tokenized asset ecosystem experiencing selective growth rather than broad-based expansion. Strength in commodities, equities, and private equity was counterbalanced by notable weakness in actively managed strategies and alternative funds. The divergence underscores the evolving nature of the RWA market, where investor sentiment, asset-class fundamentals, and the pace of new on-chain issuance all contribute to a dynamic and increasingly sophisticated landscape.

Total Tokenized Real-Word Assets Onchain

Source: RWA.xyz (As of November 30, 2025)

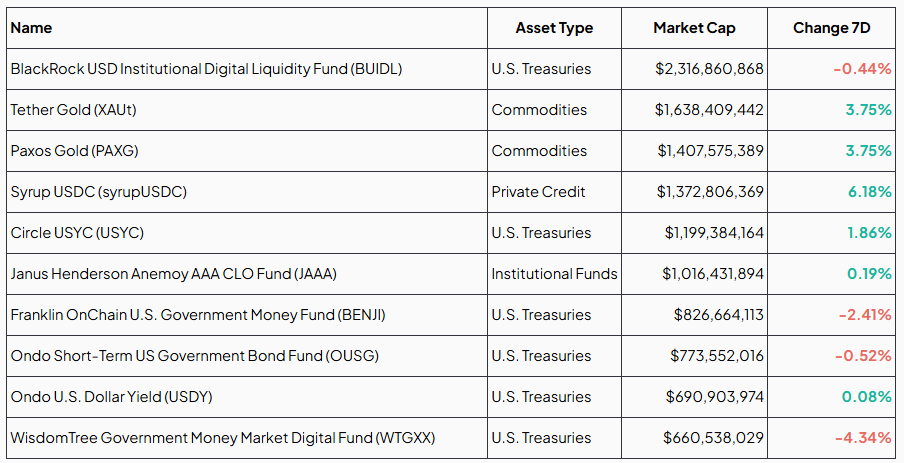

Top Ten Tokenized RWA

The top tokenized real-world asset products showed a varied set of movements this week, reflecting both asset-class dynamics and shifting investor preferences. The largest product, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), posted a 0.4% decline, bringing its market cap to $2.32 billion. While modest, the decrease suggests a slight pullback in on-chain institutional liquidity allocations, consistent with the broader pause in treasury-linked token flows observed over the past several sessions.

Commodity-backed tokens continued to gain traction. Tether Gold (XAUt) and Paxos Gold (PAXG) each rose 3.8%, pushing their market caps to $1.64 billion and $1.41 billion, respectively. These parallel increases highlight ongoing demand for tokenized gold exposure, supported by a favorable macro backdrop and sustained interest in blockchain-based representations of physical assets.

Private credit-linked products were among the strongest performers. Syrup USDC (syrupUSDC) grew 6.2% to reach $1.37 billion, marking one of the largest weekly gains in the top-ten category. The rise underscores the expanding appeal of yield-oriented on-chain credit strategies as investors seek alternatives to traditional lending markets.

U.S. Treasury-backed products delivered mixed results. Circle's USYC rose 1.9%, moving above $1.19 billion, supported by ongoing institutional adoption and the steady demand for tokenized short-duration government exposure. By contrast, Franklin Templeton's BENJI declined 2.4%, while Ondo's OUSG slipped 0.5%, and WisdomTree's WTGXX saw the sharpest decline at 4.3%, suggesting selective rebalancing across treasury-focused vehicles as investors adjust duration and yield preferences.

Institutional fund strategies showed minimal movement. The Janus Henderson Anemoy AAA CLO Fund (JAAA) rose 0.2%, maintaining a stable $1.02 billion market cap. The muted change underscores the steady profile of tokenized CLO exposure, which continues to attract investors seeking predictable, structured-yield categories within the tokenized ecosystem.

Taken together, the week reflected a diverse and evolving tokenized asset landscape: solid gains in commodities and private credit, mixed flows across U.S. Treasuries, and a slight contraction in the largest liquidity fund. These shifts illustrate how investor behavior continues to differentiate across asset types, even as the broader RWA sector remains on a steady growth trajectory.

Source: RWA.xyz (As of November 30, 2025)

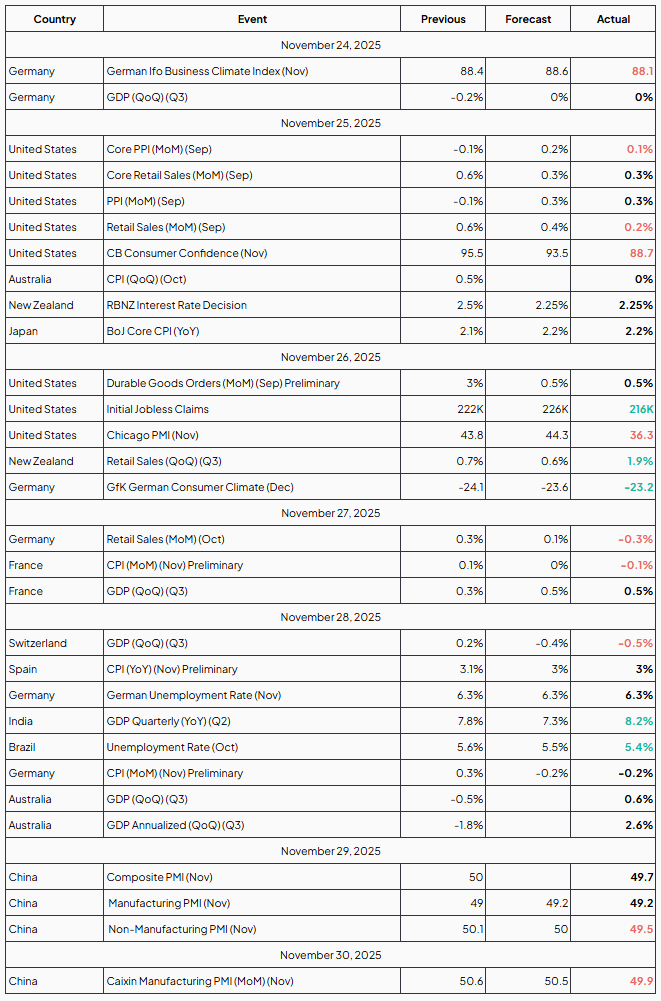

Macroeconomic Factors

Key Takeaways

German business sentiment softens in November

Germany's business climate weakened in November, with the ifo Business Climate Index slipping to 88.1, below both expectations and the previous month's reading. The decline was driven primarily by a deterioration in firms' expectations, signaling growing caution about the economic outlook despite a slight improvement in assessments of current conditions. The data suggests that companies remain concerned about sluggish demand and persistent structural challenges, underscoring the fragile state of Germany's recovery as the year draws to a close.

German GDP stalls in Q3, highlighting ongoing economic weakness

Germany's economy showed no growth in the third quarter of 2025, with GDP coming in flat after a 0.2% contraction in the previous quarter, confirming earlier estimates and underscoring the country's fragile economic backdrop. The stagnation reflects a mix of modest gains in investment offset by declining exports, while year-over-year growth remained subdued at just 0.3%. The figures reinforce concerns about Germany's medium-term economic prospects, as weak external demand, structural challenges, and limited momentum continue to weigh on the recovery.

U.S. wholesale prices firm while retail spending softens in September

U.S. economic data for September painted a mixed picture, with wholesale inflation firming even as consumer spending lost momentum. The Producer Price Index rose 0.3%, reversing the prior month's decline, while Core PPI posted a modest 0.1% increase, signaling a gradual pickup in underlying price pressures.

In contrast, retail sales slowed sharply, advancing only 0.2%, while core retail sales matched expectations but remained far weaker than earlier gains.

The combination of rising producer costs and cooling household demand suggests a more cautious consumer backdrop and highlights potential headwinds for growth as the year progresses.

U.S. consumer confidence falls to seven-month low in November

U.S. consumer confidence deteriorated sharply in November, with the Conference Board's index dropping to 88.7, down from 95.5 in October and marking the weakest reading since April. The decline reflected broad-based pessimism, as both current assessments and expectations for future business conditions, income, and employment softened notably. Households cited persistent inflation pressures, uncertainty following the recent government shutdown, and growing concerns about the labor market. The sharp pullback in sentiment raises the risk of softer consumer spending heading into the holiday season, potentially weighing on overall economic momentum.

RBNZ cuts rates to 2.25% but signals the easing cycle is nearing its end

The Reserve Bank of New Zealand lowered its Official Cash Rate to 2.25%, delivering a widely expected 25-basis-point cut aimed at supporting a sluggish economy and encouraging stronger household spending. Despite this move, the central bank indicated that further easing is unlikely, noting signs of stabilization in economic activity and growing confidence that inflation is moving toward target. The decision marks the third rate cut of the year and places the policy rate at its lowest level in more than three years, suggesting that monetary policy is now firmly in supportive territory, with future adjustments likely to be more cautious

U.S. durable goods orders show steady momentum in September

U.S. durable goods orders rose 0.5% in September, marking a second consecutive monthly increase and signaling steady business investment despite broader manufacturing headwinds. The gain, which followed a strong 3% jump in August, was supported by solid demand across sectors such as machinery, primary metals, and electrical equipment. Excluding the often-volatile transportation category, orders climbed an even firmer 0.6%, suggesting underlying corporate spending remains resilient. Overall, the data points to ongoing strength in business demand and provides a modest boost to the near-term industrial outlook.

U.S. jobless claims drop to 216K, highlighting ongoing labor-market resilience

Initial jobless claims declined to 216,000, marking their lowest level in seven months and underscoring continued strength in the U.S. labor market. The figure came in well below expectations and suggests that layoffs remain limited despite economic uncertainty and cautious hiring attitudes among firms. Although continuing claims edged slightly higher, the overall data indicates a labor market that is cooling only gradually, with employers still reluctant to reduce staff.

Chicago PMI collapses to 36.3, signaling severe contraction in regional activity

The Chicago PMI plunged to 36.3 in November, sharply below expectations and marking one of its weakest readings in over a year. The steep decline reflects broad-based deterioration across new orders, production, and employment, pointing to a significant slowdown in regional business conditions. With the index now spending nearly two years in contraction territory, the latest downturn raises concerns about deepening industrial weakness and the potential spillover to broader Midwest economic activity as year-end approaches.

German consumer sentiment improves slightly but remains deeply negative

Germany's GfK Consumer Climate index rose to -23.2 for December, marking a modest improvement from the previous month but still signaling deeply pessimistic household sentiment. The slight uptick was supported by a stronger willingness to spend and a reduced tendency to save ahead of the holiday season. However, expectations for income and overall economic conditions continued to soften, highlighting persistent concerns among consumers and underscoring the fragile state of domestic demand heading into year-end.

French growth strengthens in Q3 as inflation eases in November

France delivered a mixed but largely positive economic picture, with GDP expanding 0.5% in the third quarter, its fastest pace in several quarters, driven mainly by a rebound in exports, especially in transport equipment. At the same time, inflation softened in November, as the preliminary CPI fell 0.1% month-on-month, highlighting subdued price pressures and cautious household spending. The combination of stronger growth and easing inflation suggests that while external demand is supporting activity, domestic momentum remains fragile heading into year-end.

Swiss economy contracts as export sectors come under pressure

Switzerland's economy contracted in the third quarter, reflecting mounting strain on its export-oriented industries, particularly chemicals and pharmaceuticals. The decline marked a sharper-than-expected setback, driven by softer global demand, weaker industrial output and only modest support from the services sector. The latest figures highlight the increasing vulnerability of the Swiss economy to external headwinds and underscore the challenges it faces as the year draws to a close.

Spain's inflation edges down to 3% in November

Spain's preliminary CPI eased to 3.0% year-on-year in November, slipping slightly from 3.1% in the previous month and marking the first moderation in six months. The slowdown was driven mainly by declining energy prices, particularly electricity, which helped offset continued upward pressure from food, transport, and services. While inflation remains relatively elevated compared with some euro-area peers, the latest reading suggests price pressures may be stabilizing as the year comes to a close.

German unemployment steadies at 6.3% as labor market shows signs of strain

Germany's unemployment rate held at 6.3% in November, matching expectations and signaling a largely unchanged labor-market backdrop. Although the number of unemployed individuals rose slightly, the increase was smaller than anticipated, offering a modest sign of resilience. Even so, the broader picture remains soft, with subdued labor demand and stagnating employment growth pointing to ongoing challenges for Europe's largest economy as it navigates a period of weak momentum.

India's GDP accelerates to 8.2% in Q2, reinforcing its growth leadership

India's economy expanded by a strong 8.2% year-on-year in Q2, far surpassing expectations and marking its fastest pace of growth in six quarters. The expansion was driven by robust manufacturing output, solid construction activity, and continued strength in services, supported by resilient domestic demand and rising investment. The impressive performance reinforces India's position as one of the world's fastest-growing major economies and highlights its ability to maintain momentum despite global economic headwinds.

Brazil's unemployment rate drops to 5.4%, hitting a historic low

Brazil's unemployment rate fell to 5.4% in the quarter ending October, marking its lowest level since records began in 2012 and reflecting a notably strong labor-market performance. The improvement was driven by a rise in formal employment and a significant reduction in the number of unemployed individuals compared with a year earlier. However, despite the impressive headline figure, analysts warn that job creation is beginning to lose momentum, suggesting that the labor market may be approaching a turning point as overall economic activity cools.

German inflation declines in November as price pressures ease

Germany's preliminary CPI fell 0.2% in November, marking a notable pullback after October's increase and highlighting ongoing softness in monthly price pressures. The annual inflation rate held steady at 2.3%, while core inflation edged slightly lower, reflecting subdued domestic demand heading into the winter period. The decline reinforces the view that inflation risks are easing in Europe's largest economy, potentially shaping expectations for the broader eurozone's policy outlook in the months ahead.

Australian economy rebounds in Q3 with stronger-than-expected growth

Australia's economy strengthened notably in the third quarter, with GDP rising 0.6% after a period of softer performance. The rebound was supported by solid domestic demand, including firm household consumption, increased government spending, and a pickup in business investment, which together helped offset lingering external headwinds. While the improvement suggests a stabilizing economic backdrop, analysts note that momentum remains uneven, and the durability of this upswing will depend on how well demand holds up in the coming quarters.

China's November PMIs point to renewed economic contraction

China's economy showed fresh signs of weakness in November, with the official Composite PMI slipping to 49.7, its first contraction in nearly three years. Manufacturing activity remained subdued, holding at 49.2, while the Non-Manufacturing PMI fell to 49.5, signaling a rare decline in the services and construction sectors. The downturn highlights persistent soft demand, pressures across multiple industries, and growing concerns over the country's near-term growth trajectory. The Caixin Manufacturing PMI also softened to 49.9, reinforcing the picture of broad-based cooling across both domestic and external-facing sectors.

Week's Overview

Source: Investing.com

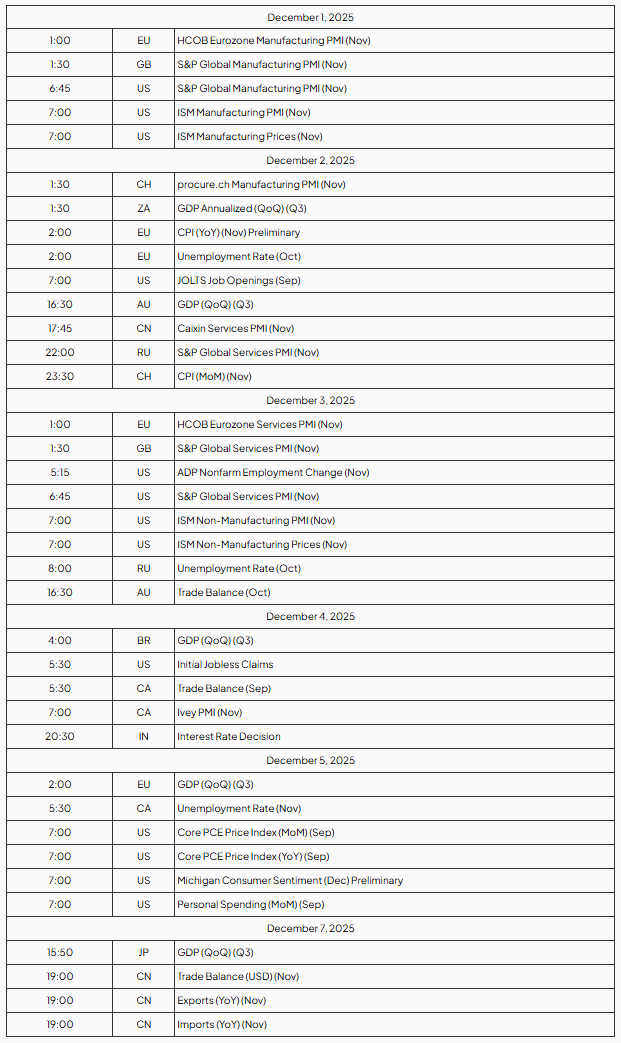

The Week Ahead

Next week's data releases offer a broad view of global economic conditions, with a strong focus on U.S. labor and services activity through ADP employment, jobless claims, and key PMI readings. Core PCE and Michigan Sentiment will also help refine expectations around inflation and consumer strength.

Internationally, the U.K. and Eurozone will publish Manufacturing and Services PMIs alongside the Eurozone's preliminary CPI and unemployment data, providing a clear read on regional activity and price dynamics. Canada's Ivey PMI and unemployment rate add further context, while China's trade figures will offer an important gauge of global demand. Altogether, the week delivers a comprehensive snapshot of activity, labor markets, inflation pressures, and trade conditions across major economies.

Source: Investing.com Time: (GMT/UTC - 8h)

Regulation Environment

Franklin Templeton's XRP ETF secures NYSE listing approval

The approval of Franklin Templeton's spot-XRP ETF for listing on NYSE Arca marks a significant milestone for both institutional and retail access to digital assets. With the ETF set to trade under the ticker XRPZ, investors can now gain regulated exposure to XRP without directly holding the cryptocurrency. The move reinforces the growing acceptance of digital assets within traditional finance and is expected to boost market liquidity, attract new capital, and further legitimize XRP in the broader investment landscape.

Grayscale launches first Dogecoin ETP in the US with GDOG debut

Grayscale has officially launched GDOG, the first Dogecoin exchange-traded product available in the United States, with trading beginning on NYSE Arca on November 24, 2025. This milestone marks Dogecoin's transition from an internet meme to a fully recognized investment asset within traditional finance. By offering regulated, brokerage-based access to Dogecoin, GDOG enables investors to gain exposure to the popular cryptocurrency without managing wallets or handling digital custody. The debut underscores growing demand for diverse crypto investment products and further expands the presence of alternative digital assets in mainstream markets.

Japan's FSA to require crypto exchanges to hold liability reserves

Japan's Financial Services Agency (FSA) has introduced new rules that will require cryptocurrency exchanges to maintain dedicated liability reserves to protect users in the event of hacks or security breaches. Set to take effect following formal legislation in 2026, the measure is designed to ensure that exchanges have sufficient funds available to quickly compensate customers if their assets are compromised. This move follows a series of high-profile security incidents in the global crypto industry and reflects Japan's ongoing commitment to strengthening investor protection and improving exchange oversight. By aligning crypto platforms more closely with traditional financial institutions, the FSA aims to elevate security standards and reinforce trust in the country's rapidly growing digital asset market.

Texas becomes first U.S. state to purchase Bitcoin for strategic reserve

Texas has made history by becoming the first U.S. state to officially purchase Bitcoin, investing $10 million into a newly established strategic reserve. The initial allocation was executed through the iShares Bitcoin Trust (IBIT), with long-term plans to move toward direct, self-custodied Bitcoin once the state's custody infrastructure is finalized. This landmark move positions Texas as a pioneer in integrating digital assets into public treasury management, signaling a growing recognition of Bitcoin as a legitimate long-term store of value. The initiative is expected to influence other states exploring ways to diversify reserves and modernize financial strategy in an increasingly digital economy.

Bitwise launches BWOW Dogecoin ETF with 16.43 million DOGE and temporary fee waiver

Bitwise has officially launched its Dogecoin ETF, trading under the ticker BWOW, on the New York Stock Exchange. The fund holds approximately 16.43 million DOGE in custody and is designed to offer investors secure, regulated exposure to Dogecoin without the need to manage wallets or private keys. BWOW carries a standard management fee of 0.34%, but Bitwise is temporarily waiving this fee for the first month on up to $500 million in assets under management, giving early investors a zero-fee entry window. Custodied by Coinbase Custody Trust Company, the ETF further expands institutional access to Dogecoin and strengthens Bitwise's position in the rapidly growing market for crypto-linked investment products.

Nasdaq seeks SEC approval to raise IBIT options limit to one million contracts

Nasdaq's International Securities Exchange has filed a proposal with the U.S. Securities and Exchange Commission to increase the option position limit on BlackRock's iShares Bitcoin Trust (IBIT) from 250,000 contracts to 1,000,000 contracts, the highest level allowed. The exchange argues that the current cap has become restrictive due to IBIT's exceptional liquidity and trading volume, which now rival those of top-tier equity and index ETFs. Raising the limit would give institutional investors and market makers significantly more flexibility in hedging and advanced trading strategies, while also supporting deeper liquidity and tighter spreads in the expanding Bitcoin options market. If approved, the move would place IBIT options among the most actively tradable products in the U.S. markets, further solidifying Bitcoin's integration into mainstream financial infrastructure.

Securitize becomes first regulated digital securities operator in both the US and EU

Securitize has secured full approval from the European Union to operate a regulated tokenized trading and settlement system on the Avalanche blockchain, marking a landmark achievement in global digital finance. Authorized under the EU's DLT Pilot Regime and supervised by Spain's CNMV, the platform will support the issuance, trading, and on-chain settlement of tokenized securities such as equities, bonds, and investment funds. With this approval, Securitize becomes the only company licensed to run fully regulated digital-securities infrastructure across both the United States and the European Union, creating an unprecedented bridge between the world's two largest capital markets. By leveraging Avalanche's high-speed, sub-second settlement capabilities, Securitize aims to modernize traditional finance with greater transparency, efficiency, and reduced operational friction, opening the door to a new era of institutional-grade on-chain securities.

Amundi launches first tokenized euro money market fund share on Ethereum

Amundi, Europe's largest asset manager, has launched its first tokenized share class for a euro-denominated money market fund on the Ethereum blockchain, marking a major milestone in the tokenization of traditional finance. The new share class, Amundi Funds Cash EUR - J28 EUR DLT, offers investors an on-chain alternative to the traditional fund structure, with blockchain-based subscription and redemption processes and near-instant settlement. The first tokenized transaction was executed on November 4, 2025, in collaboration with CACEIS, leveraging a hybrid distribution model that enables both traditional and blockchain-native investor access. By bringing one of its conservative, short-term debt-based funds onto Ethereum, Amundi signals strong institutional confidence in real-world asset tokenization and lays groundwork for a broader expansion of blockchain-powered investment products across Europe's financial ecosystem.

Uzbekistan to recognize stablecoins as official payment method starting 2026

Uzbekistan has announced a major overhaul of its digital-asset framework, confirming that stablecoins will become an officially recognized payment method beginning January 1, 2026. The new regulatory regime, overseen by the National Agency for Perspective Projects (NAPP) and the Central Bank, will also introduce a sandbox enabling the issuance and trading of tokenized stocks and bonds. This shift allows individuals and businesses to legally use fiat-backed stablecoins for everyday transactions, marking a dramatic expansion from previous restrictions on crypto payments. By enabling tokenized securities and integrating blockchain-based payment systems into its regulated financial architecture, Uzbekistan aims to accelerate fintech development, attract foreign investment, and position itself as a regional hub for digital-asset innovation.

UK to require crypto platforms to report all user transactions starting in 2026

The United Kingdom has unveiled strict new regulations that will require all crypto platforms operating in the country to report every transaction made by UK-based users beginning on January 1, 2026. Under the updated HMRC rules, exchanges and custodial services must collect detailed customer information, including identity data and full transaction histories, and submit it to tax authorities as part of the country's implementation of the global Crypto-Asset Reporting Framework (CARF). The mandate applies to all transfers, even those conducted entirely within the UK, marking one of the most comprehensive crypto-tax transparency regimes in the world. The first reports will be filed in 2027, covering activity throughout 2026, with platforms facing penalties for non-compliance. The move is aimed at tightening oversight, reducing tax evasion, and aligning crypto-asset tracking with traditional financial reporting standards.

Technology and Innovation

Crypto.com enables Google Pay support for UK Visa cardholders

Crypto.com has introduced Google Pay compatibility for its Visa card users in the United Kingdom, allowing them to add their cards to Google Wallet for seamless digital payments. This update enables cardholders to make secure contactless transactions in stores, apps, and online using their Android devices. By integrating with Google Pay, Crypto.com enhances everyday usability for its crypto-linked cards, automatically converting digital assets to fiat at checkout and further bridging traditional finance with the digital economy.

Kraken launches Krak Mastercard debit app across the UK and EU

Kraken has officially introduced its Krak Mastercard debit app to users in the UK and EU, offering real-time multi-asset spending and seamless integration with both crypto and fiat balances. The card supports instant conversions at checkout from more than 400 assets, enabling flexible payments anywhere Mastercard is accepted. A key feature of the launch is the addition of IBAN salary deposits, allowing users to receive their pay directly into their Krak account as a full alternative to traditional banking. With perks like 1% cashback, no monthly or foreign exchange fees, and compatibility with Kraken's broader financial ecosystem, the Krak debit app positions itself as a modern, crypto-friendly solution for everyday money management.

Genesis Mission launches to accelerate AI-driven scientific innovation

The United States has unveiled the Genesis Mission, a major national initiative designed to transform the pace and power of scientific research through advanced artificial intelligence. Led by the Department of Energy, the program unifies federal supercomputers, national laboratories, massive scientific data repositories, universities, and private industry into a single AI-enhanced research ecosystem. By embedding AI deeply into fields such as energy, biotechnology, materials science, and national security, the initiative aims to compress discovery timelines from years to months. The Genesis Mission represents a pivotal shift in how the country approaches innovation, signaling a future in which AI serves as a foundational engine for scientific breakthroughs at unprecedented scale.

Binance Wallet launches On-Chain Stocks with zero-fee tokenized trading

Binance Wallet has introduced On-Chain Stocks, a new feature that allows users to trade tokenized versions of major global equities directly on the blockchain with 0% transaction fees. The service enables 24/7 trading, fractional share ownership, and instant on-chain settlement without the need for a traditional brokerage. Users can access tokenized shares of popular companies such as Apple, Tesla, and Amazon, all while maintaining full custody of their assets within the Binance Wallet environment. This launch marks a significant step in merging traditional financial markets with Web3 infrastructure, expanding global access to equity markets through a secure, transparent, and low-cost on-chain system.

Standard Disclaimer: This report is provided for informational purposes only and does not constitute legal, financial, or investment advice. The views expressed represent the author's perspective at the time of publication and may change as market conditions develop. Although the information is drawn from sources deemed reliable, its accuracy and completeness are not guaranteed. Readers should exercise their own judgment and perform due diligence before making any decisions based on this report.

Contributors

Ana CabaleiroFinancial Analyst