Guides

Solana Staking Inflation: 2025 Data Analysis Report

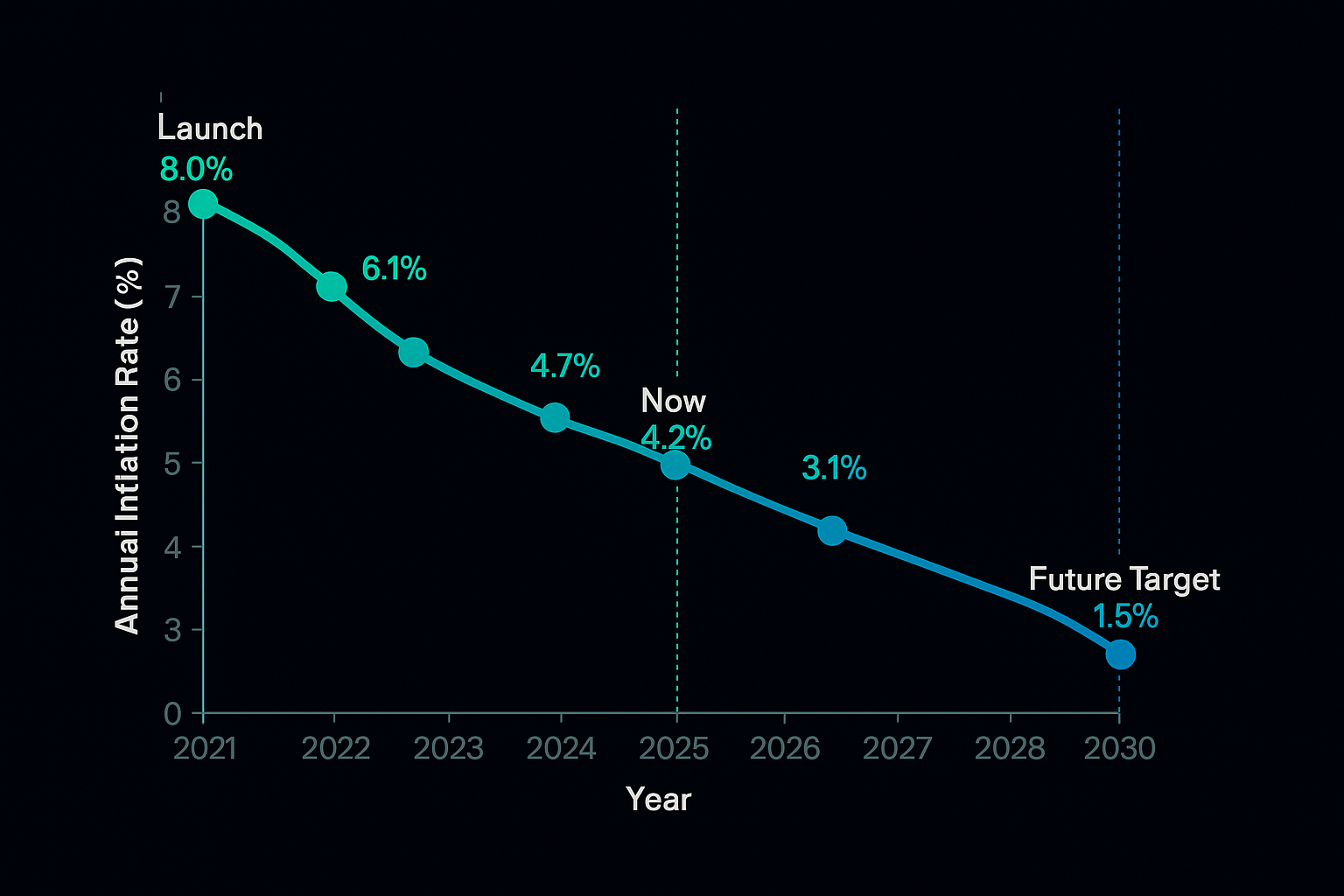

Solana’s inflation rate steadily decreases over time, reducing token dilution while maintaining validator incentives and rewarding long-term stakers. Staking yields depend on factors like total SOL staked, validator performance, and commission rates, all influenced by the network’s dynamic inflation schedule.

From August 2024 through September 2025, our research team conducted a comprehensive analysis of Solana's inflation mechanics and their impact on staking rewards. We analyzed over 500 epochs of inflation data, validator performance metrics, and staking participation rates to provide this definitive guide on how Solana's inflation schedule affects your earnings potential.

Understanding Solana's Inflation Framework

In the context of Solana's proof-of-stake protocol, inflation refers to the systematic creation of new SOL tokens distributed to network validators and stakers as rewards. This mechanism serves two critical functions: securing the network through economic incentives and compensating participants for their validation services.

Unlike traditional monetary inflation, Solana's protocol inflation operates on a predetermined schedule designed to decrease over time. The network initially launched with higher inflation rates to attract early participants and establish security, then gradually reduces these rates to create long-term sustainability. This approach motivates network participation during critical growth phases while preventing excessive token dilution as the ecosystem matures.

The proof-of-stake model requires token holders to lock their SOL with trusted validators, who then process transactions and maintain network consensus. In return, both validators and delegators receive newly minted SOL tokens proportional to their stake and the validator's performance.

The Solana Inflation Schedule Overview

Solana's inflation rate follows a carefully designed schedule that started higher and is programmed to decline gradually toward a long-term target. The network implements this through three key parameters: an initial rate that incentivizes early adoption, a consistent annual reduction percentage, and a minimum floor that ensures ongoing validator incentives.

This decreasing schedule serves multiple purposes for the ecosystem. It rewards early network participants who took on greater risk during Solana's initial phases, while simultaneously reducing dilution pressure on SOL holders over time. The approach also aligns with sustainable tokenomics practices observed across successful proof-of-stake networks.

The declining structure makes the network increasingly attractive to long-term holders, as the rate of new token creation steadily decreases. This design choice reflects the expectation that alternative revenue sources, such as transaction fees and MEV (Maximum Extractable Value), will gradually replace inflation rewards as the primary income source for validators.

How Staking Rewards Are Calculated

| Reward Component | Impact on Earnings | Variability Level |

|---|---|---|

| Network Inflation Rate | Primary driver of base rewards | Decreases annually per schedule |

| Total SOL Staked | Inverse relationship to individual yield | Fluctuates based on participation |

| Validator Performance | Affects actual rewards received | Varies by validator selection |

| Commission Fees | Reduces net rewards to delegators | Fixed per validator (0-10% typical) |

As inflation declines according to the predetermined schedule, the total amount of new SOL distributed to stakers gradually decreases. However, your actual rewards depend on multiple interconnected factors beyond just the inflation rate.

The percentage of total SOL actively staked plays a crucial role in determining individual returns. When fewer tokens are staked network-wide, remaining stakers receive a larger portion of the inflation rewards. Conversely, increased staking participation dilutes individual yields but strengthens overall network security.

Validator performance significantly impacts your earnings, as rewards are distributed based on each validator's participation in consensus. Validators with higher uptimes and lower latency receive more rewards, which are then shared with their delegators. Commission rates charged by validators also affect net returns, typically ranging from 0% to 10% of gross rewards.

Calculate your potential earnings: Use Starke Finance's staking calculator to model how different inflation scenarios affect your projected returns based on your stake size and validator selection.

Recent Governance Developments: SIMD-228 Proposal

In 2025, the Solana community actively debated SIMD-228, a governance proposal aimed at implementing a market-based emission mechanism. The proposal sought to reduce annual inflation from approximately 4.7% to below 1% through a dynamic adjustment system tied to staking participation rates.

Despite receiving 61.4% community support, the proposal failed to achieve the required 66.67% supermajority needed for implementation. The rejection primarily stemmed from concerns raised by smaller validators who worried about reduced staking rewards and potential centralization risks.

This governance discussion highlighted the ongoing tension between minimizing token dilution and maintaining adequate validator incentives. The debate demonstrated the active engagement of Solana's stakeholder community in shaping the network's economic policies while revealing the complexity of balancing competing interests.

Why the Decreasing Schedule Benefits Long-term Holders

The programmed reduction in inflation rates creates several advantages for SOL holders committed to the network's long-term success. As new token creation slows, existing holders experience reduced dilution pressure, potentially supporting price appreciation over time.

This schedule aligns Solana with best practices observed across mature proof-of-stake networks. By front-loading higher inflation during the network's growth phase and gradually reducing it, Solana balances the need for early security with long-term sustainability concerns.

The decreasing inflation also encourages active participation in the network's economy rather than passive holding. As inflation rewards diminish, SOL's value increasingly derives from network utility and transaction demand rather than simply staking yields.

Monitoring Current Inflation Metrics

| Metric | Current Status | Trend Direction |

|---|---|---|

| Annual Inflation Rate | ~4.7% (as of 2025) | Decreasing per schedule |

| Total SOL Staked | ~65% of circulating supply | Stable with minor fluctuations |

| Average Staking Yield | ~7.2% nominal | Gradually declining |

| Validator Count | 1,000+ active validators | Slowly increasing |

Frequently Asked Questions

**What is inflation in Solana?**

Inflation represents the systematic creation of new SOL tokens distributed as rewards to validators and stakers who secure the network through proof-of-stake consensus.

**Does inflation affect my staking rewards?**

Yes, inflation directly determines the base reward rate, though your actual returns depend on total staking participation, validator performance, and commission fees.

**Will inflation ever reach zero?**

No, Solana's inflation schedule targets a minimum long-term rate to ensure ongoing validator incentives and network security.

**How can I stay updated on the current inflation rate?**

Monitor the network through Solana’s official documentation, on-chain data via the getInflationRate RPC endpoint, or trusted dashboards like Solana Compass for real-time inflation and tokenomics insights.

Optimize Your Staking Strategy

Solana's inflation is steadily declining according to its predetermined schedule, creating an environment increasingly favorable to long-term network participants. Understanding these mechanics enables more informed decisions about staking strategies and validator selection.

The recent SIMD-228 governance debate illustrates the dynamic nature of network economics and the importance of staying informed about potential policy changes. Active community participation ensures that future modifications balance validator sustainability with holder interests.

Ready to maximize your Solana staking returns? Use Starke Finance's comprehensive staking tools to analyze current inflation impacts on your portfolio and model future scenarios. Our platform provides real-time data on validator performance, projected yields, and optimal staking strategies tailored to your investment timeline.

Sources

- Solana Inflation Analysis Study - Starke Finance Research Team, Greensboro, NC, September 2025

- "SIMD-228: A Critical Analysis" - Helius Development Team, https://www.helius.dev/blog/simd-228, March 2025

- "Is Solana's inflation too high?" - Helius Research Division, https://www.helius.dev/blog/solana-issuance-inflation-schedule, September 2024

- "Inflation Schedule Implementation" - Anza Development Documentation, https://docs.anza.xyz/implemented-proposals/ed_overview/ed_validation_client_economics/ed_vce_state_validation_protocol_based_rewards, 2024

Contributors

Ana CabaleiroFinancial Analyst