Guides

Solana Staking Statistics 2025: The Liquid Leap

Solana staking is at an inflection point: liquid instruments are growing fast, yet native participation remains remarkably high.

Reading Time: 4 minutes

Solana staking is at an inflection point: liquid instruments are growing fast, yet native participation remains remarkably high. The numbers that follow reveal where capital is moving and how liquid-staking tokens are jockeying for dominance in the interim.

This report covers:

- Continued epoch-level stake volatility as investors attempt different strategies

- How liquid staking’s share doubled in 18 months and why the trajectory is far from finished

- How liquid staking tokens’ market share has evolved and the opportunities that creates

- Why opportunities will continue to exist in the Solana ecosystem based on one consistent metric

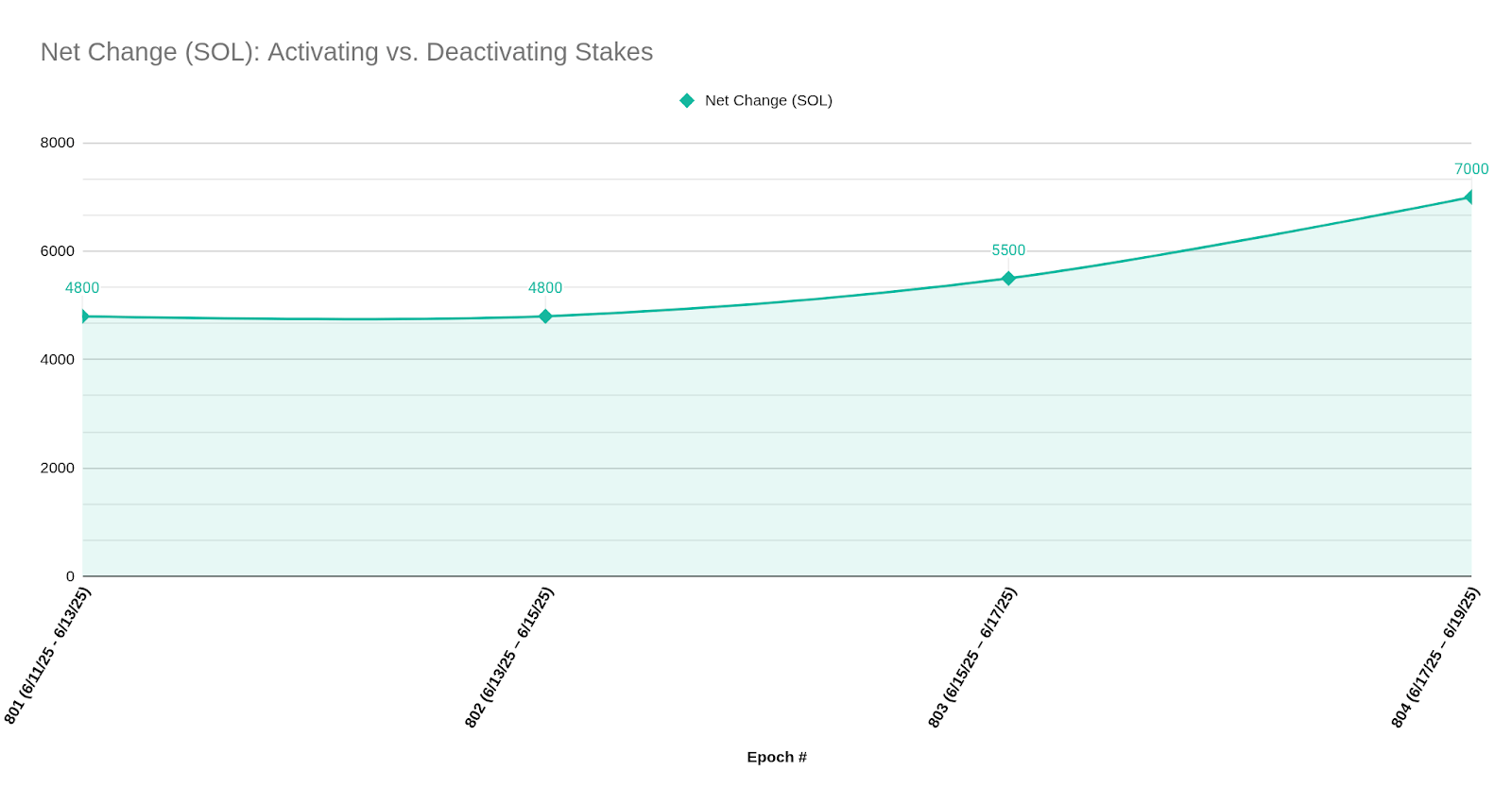

Epoch-Level Stake Volatility

Solana stake flows dynamically between active and inactive status every epoch. Our data from recent epochs shows persistent net outflows, spotlighting staking volatility and highlighting the importance of liquidity solutions for stakers facing fluctuating market conditions.

Stake inflows and outflows on Solana have consistently shown volatility. Recent epochs illustrate consistent net negative flows of up to 7,000 SOL. Such movements signal periods where more stakers are deactivating stakes than activating, often due to market uncertainty or yield optimization strategies.

This volatility underscores challenges associated with native staking methods, primarily the standard ~2-day cooldown. During these periods, stakers remain locked, unable to reposition capital in rapidly shifting markets.

Key considerations

| Liquidity Flexibility | Stakers using instruments like rkSOL from Starke can instantly reposition, avoiding cooldown risk. |

|---|---|

| Market Position | Persistent volatility is an ongoing driver toward liquid staking adoption. |

| User Behavior Insight | Volatile epochs increasingly push users toward instruments offering immediate liquidity, real-time reward accrual, and flexibility where rkSOL may benefit. |

Adoption of Liquid vs. Native Staking

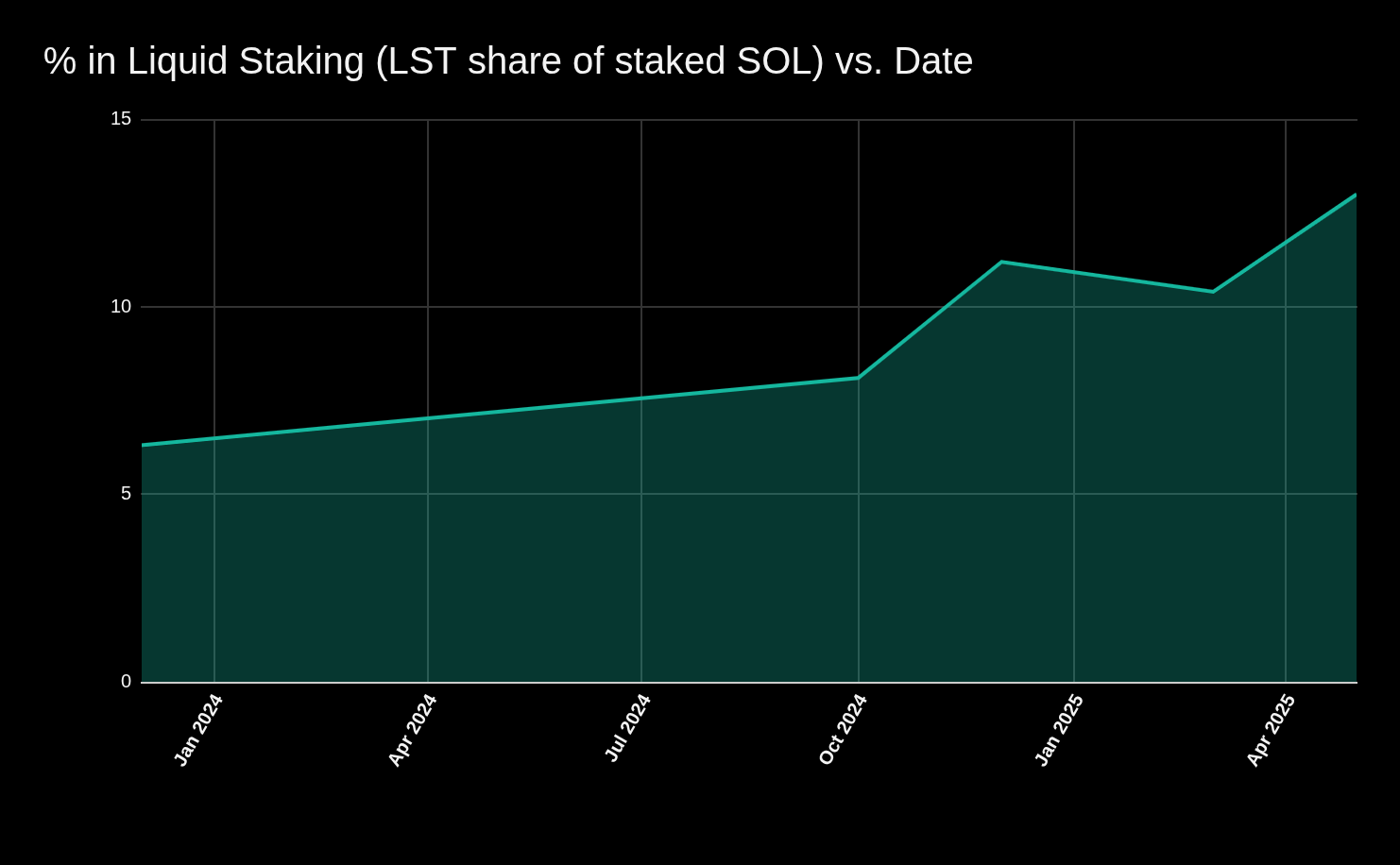

With the above dimensions in mind, it’s no surprise that liquid staking adoption has surged notably since late 2023. By May 2025, approximately 13% of all staked SOL was locked into liquid staking solutions, representing a significant shift away from native staking due to flexibility demands from users.

Takeaways

- Rapid Adoption - LST usage doubled from approximately 6.3% to 13% in under two years.

- Market Preference - Clear preference emerging for liquidity and rapid access to funds during volatile markets.

- Shift in User Behavior - Increasing willingness of stakers to accept smart-contract risk for increased flexibility, evidenced by rapid adoption rates.

- Opportunity for Growth: Even with rapid growth, 87% of SOL remains in native staking—a large market segment that liquid staking adopters can consider moving forward.

Instant Liquidity Value from Avoiding SOL Cooldown Periods

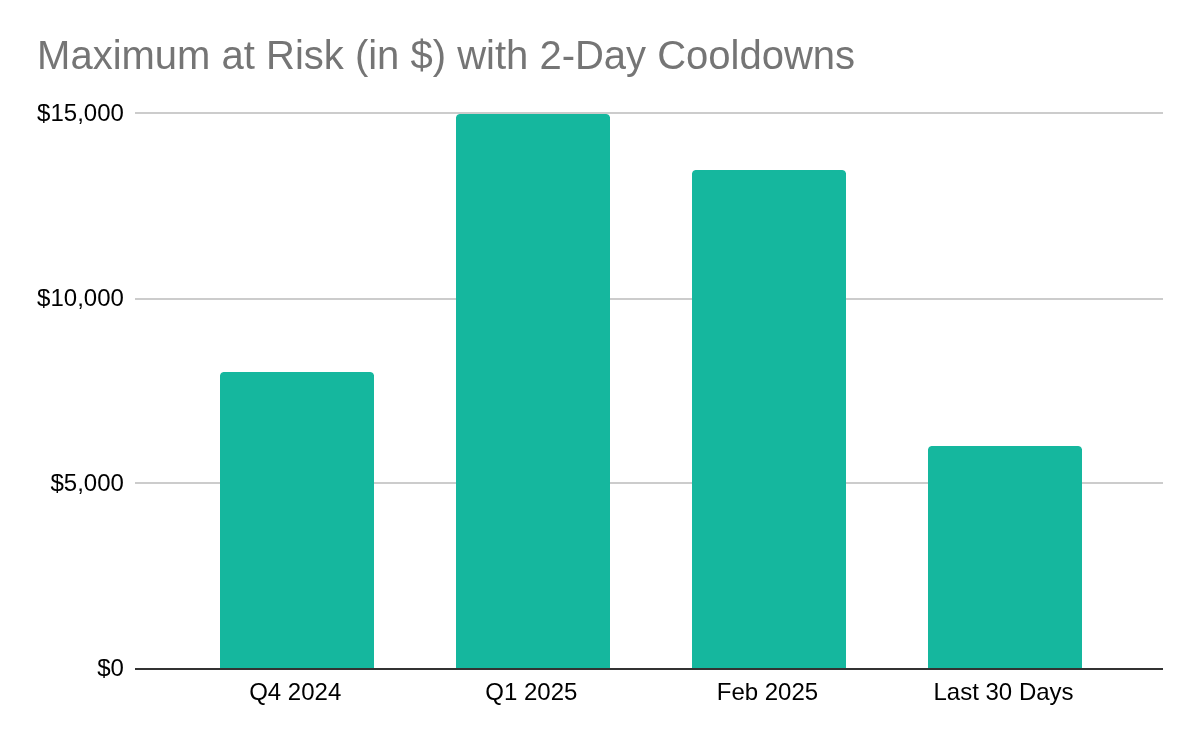

The average two-day price volatility (Absolute) for SOL was about 4.2% in Q4 2024, ~8–9% in Q1 2025, ~8% in February 2025, and ~3.7% in the last 30 days. We assumed an average SOL price of roughly $190 in Q4 2024, $170 in Q1 2025, $180 in Feb 2025, and $162 recently. Facing a two-day cooldown, stakers opting to go native put the following at risk, (assuming a 1000 SOL stake):

Maximum figures of $15,000 per 1,000 SOL staked and even lower amounts like $3,000 highlight how liquid staking’s instant liquidity can save thousands of dollars in value during turbulent markets. By enabling immediate exit or reallocation, liquid staking lets investors avoid the ~2-day price swings that native stakers must endure during the lockup. (For example, SOL hit an all-time high of ~$294 in January 2025 then plunged over 50% within weeks. Such data underscores the opportunity cost of the cooldown and the value preserved by having the flexibility to trade or hedge immediately via liquid staking.)

If you’re ready to leverage liquid staking to reduce volatility exposure, launch the app.

Liquid Staking Token (LST) Market Share Evolution

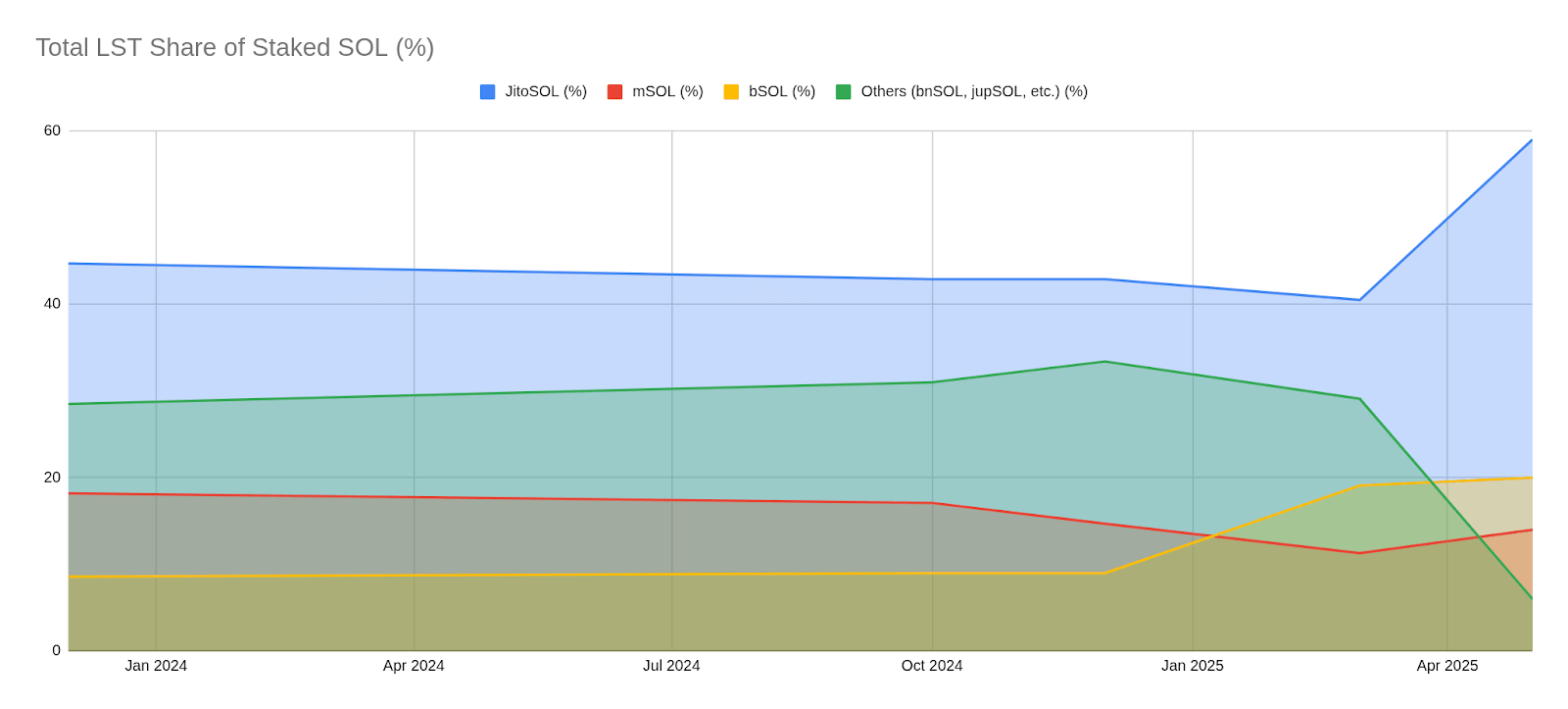

Since late 2023, liquid staking tokens (LSTs) have nearly doubled their market penetration among Solana stakers. The market remains highly competitive, dominated primarily by JitoSOL, with significant shifts visible among smaller players, signaling ample room for innovative protocols to disrupt.

The LST market on Solana is rapidly maturing, with total share rising sharply from just 6.3% in December 2023 to approximately 13% by mid-2025. This adoption surge demonstrates a clear preference among Solana stakers for liquidity and flexibility over traditional native staking methods.

Key Developments

| Dominance of Jito SOL |

|---|

| Solidified a substantial portion, ~34%, of the LST market by June 2025. However, avenues exist for competitors. |

| Growth of bSOL |

|---|

| Emerged as a significant alternative, securing about 20% of the LST market. |

| Declining mSOL Share |

|---|

| Marinade's mSOL fell from 18.2% to ~14%, indicating opportunities for differentiation. |

Total Staked SOL and Participation Rate

Throughout 2025, Solana staking remained robust, consistently maintaining approximately 392–397 million SOL staked. By mid-year, nearly 75% of circulating SOL supply was actively staked, underscoring sustained community confidence and engagement despite market fluctuations. We don’t want to waste your time with a boring graph because the trend line is flat.

The sustained staking ratio highlights the resilience and deep-rooted confidence within the Solana community. Even amidst market volatility and shifting preferences toward liquidity, overall staking levels remained consistently high. Such resilience is noteworthy, suggesting stakers remain fundamentally bullish on Solana’s ecosystem.

However, within this stable landscape lies the critical narrative of capital shifting. Increasing adoption of liquid staking instruments reflects stakers' evolving priorities:

| Adoption Dimension | Context |

|---|---|

| Flexibility and Risk Management | Users prioritize ability to reposition capital swiftly, especially in volatile market periods. |

| Yield Optimization | Instant access via liquid staking allows users to more actively manage and optimize yields. |

| Market Implication | The continued dominance of native staking at 85+% highlights significant potential for ongoing growth in liquid staking adoption. |

For more information or to obtain a copy of this report, contact us at Starke Finance. If you’re looking for liquid staking opportunities after seeing the trends discussed above, launch the app.

Contributors

Linh NguyenCommunication Manager