Research

Starke Finance Solana Validator Report - November 2025

In November, Starke Finance delivered strong reliability and above-average rewards, maintaining trust and stability despite network-wide SFDP reductions.

Download the PDF

Estimated Reading Time: 12 minutes

Summary

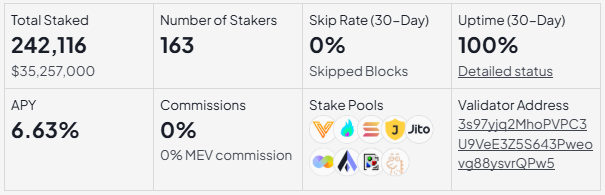

In November, Starke Finance continued to deliver strong and dependable performance within the Solana validator ecosystem, achieving 100% uptime, near-perfect vote success, and consistently low skipped leader slots. Our validator maintained an average APY of 6.57%, exceeding the cluster benchmark of 6.33%, supported by our 0% commission on both base staking rewards and Jito MEV rewards, ensuring delegators capture the full value of their stake.

Stake levels declined by 4.14%, moving from 249,151 SOL to 241,963 SOL by epoch 887. This contraction was driven primarily by the network-wide reduction in the Solana Foundation Delegation Program, which continues to scale down allocations across all validators until approximately epoch 893. Independent delegations remained stable throughout the month, reflecting sustained community trust despite these programmatic outflows.

Operational performance remained exceptionally strong. Starke Finance recorded an average TVC of 6.9 million, consistently outperforming the cluster average and ranking within the upper tier of the validator set. Leader slot execution was similarly reliable, with 0% skipped slots in 14 of 15 epochs, and a single minor deviation early in the month. Vote success maintained 100% accuracy in nearly every epoch, placing the validator well above or aligned with cluster-wide results.

Staking dynamics showed healthy organic growth, with stake accounts increasing from 114 to 159, signaling continued engagement from new delegators. Our stake base remains well-diversified: rkSOL and SFDP each contributed just over 30% of total active stake, followed by Jito, DoubleZero, The Vault, dynoSOL, JPool, and Edgevana, along with a broad mix of independent delegators and several stake pools that collectively strengthen the balance and resilience of our delegation profile.

Even as the network undergoes adjustments and broad reductions in Foundation-managed stake, Starke Finance remains a resilient, high-performing, and trusted validator. With the upcoming launch of our managed tokenized fund service, we are positioned to expand organic delegations while continuing to deliver sustainable, above-average returns backed by transparent operations, strong infrastructure, and a performance-driven ethos.

General Overview

Starke Finance has been an active participant in the Solana validator ecosystem since April 2024, maintaining a strong and consistent operational record throughout our time on the network. We have demonstrated reliability, stability, and a commitment to best practices, contributing to the overall security and decentralization of the Solana ecosystem.

In November, we upgraded from version 3.0.8 to 3.0.11, placing Starke Finance among the 36.3% of Solana validators already running the latest Agave release. Operating under the identity key 3s97yjq2MhoPVPC3U9VeE3Z5S643Pweovg88ysvrQPw5, our validator now delivers greater stability, improved transaction processing, and optimized resource utilization, ensuring full alignment with Solana's most recent network advancements.

With a 0% commission on both standard staking rewards and Jito MEV rewards, we enable delegators to maximize their yield from their stake. This competitive reward structure, combined with our consistent operational performance, reinforces Starke Finance's reputation as a dependable, performance-driven validator and a trusted contributor to the network.

In addition to our technical excellence, we place a strong emphasis on security and regulatory compliance. We adhere to ISO 27001 and SOC 2 standards, underscoring our dedication to maintaining the highest levels of operational integrity and data protection.

Source: Starke Finance, Firedancer (as of December 3, 2025).

Validator Performance

This section details key Solana validator performance metrics from Starke Finance's operations over Epochs 873-887 (October 31 - November 30, 2025), providing an in-depth look at yield for delegators, uptime, and overall staking efficiency during the month.

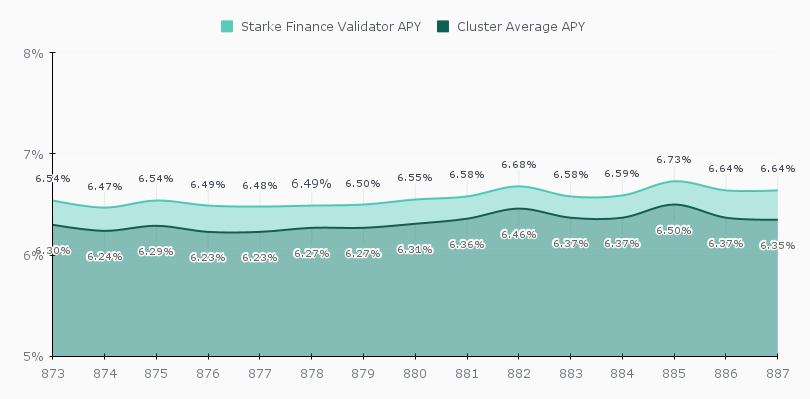

APY

In November, Starke Finance once again delivered returns that outpaced the network average, reinforcing our consistent performance leadership across recent epochs. Throughout Epochs 873-887, our validator achieved an average APY of 6.57%, surpassing the cluster-wide benchmark of 6.33% by 24 basis points.

This continued outperformance reflects the strength of our zero-commission model, exceptional uptime, and active engagement in consensus, all of which contribute to maximizing rewards for our delegators and deliver consistent, reliable staking returns.

Source: JPool.

APY is based on a 10-epoch median, combining base staking and Jito MEV yields.

Why Solana's average APY has been declining (but not this month)

Solana's long-term APY trend continues to drift downward, even though this month showed a slight stabilization, and even a mild uptick in some epochs. The broader reasons remain the same

- More staked SOL, same reward pool: As total staked SOL grows, inflation-based rewards are shared among more stakers, reducing per-SOL yield.

- Less MEV and fewer priority fees: Earlier yield boosts from MEV and network congestion have normalized as Solana stabilized.

- Tighter competition: With more validators running at near 100% uptime, yield differentials have narrowed, a sign of a stronger, more efficient network.

What to expect next

Short-term yields may trend slightly lower due to ongoing inflation adjustments, a steady increase in total staked SOL, and cluster-wide efficiency gains. Still, higher transaction volumes could support recovery due to an increase in block inclusion competition, generating higher MEV yields.

Amid these shifts, Starke Finance remains positioned to lead, combining robust infrastructure, full MEV revenue share, and a zero-commission model to deliver consistent, above-average rewards for our community of starkers.

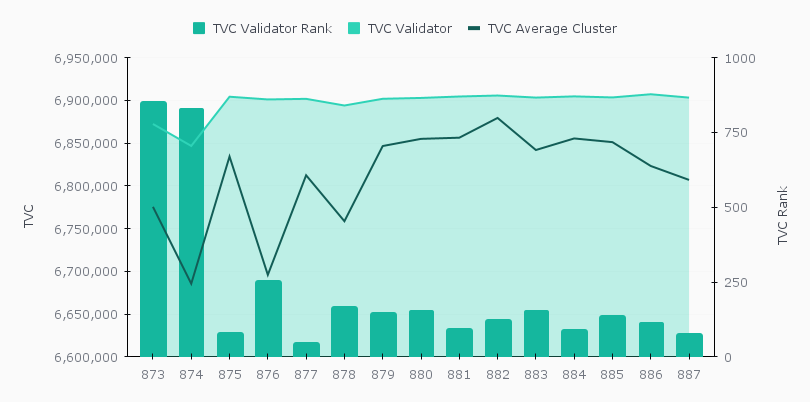

Timely Vote Credits (TVC)

Over the past set of epochs, Starke Finance recorded an average Timely Vote Credit (TVC) of 6.9 million, outperforming the cluster average of 6.8 million. This consistent efficiency highlights the stability of our validator infrastructure and our reliable participation across consensus rounds, reaffirming our strong operational performance within the Solana network.

Across epochs 873 to 887, our validator demonstrated solid and sustained results, with rankings ranging from a high of 47 to broader placements in the top-performing half of the network. Notably, several epochs placed us well within the top 100, showcasing our responsiveness and competitiveness. Overall, our average rank over this period places Starke Finance comfortably within the upper tier of validators.

For delegators, this level of consistency translates into predictable and dependable rewards, as timely voting directly influences yield under Solana's TVC-based reward model. Starke Finance's latest TVC performance reinforces our reliability and ongoing commitment to ensuring every delegated SOL operates with maximum efficiency.

Source: JPool

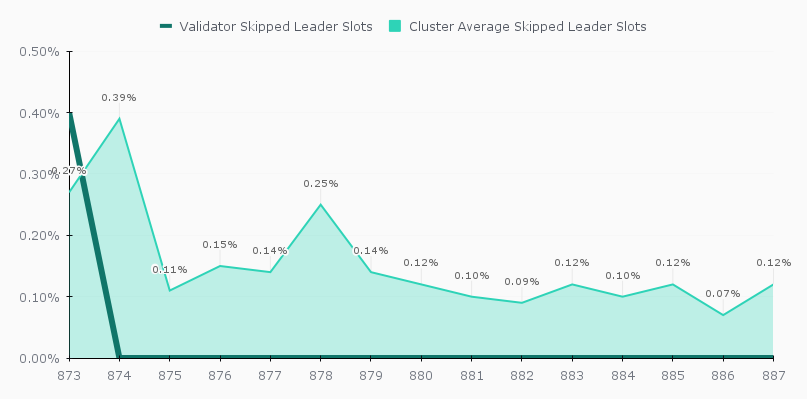

Skipped Leader Slots

Starke Finance continued to demonstrate outstanding leader slot reliability throughout the past 15 epochs, maintaining a 0% skipped leader slot rate in 14 out of 15 periods. The only deviation occurred in epoch 873, where a minimal 0.4% skip rate was observed, a small and isolated fluctuation. All subsequent epochs returned to a flawless 0% skip rate, underscoring the stability and responsiveness of our validator infrastructure.

During this same period, the cluster average skip rate ranged between 0.07% and 0.39%, consistently above our own results. This reinforces Starke Finance's strong operational performance and reliability in producing assigned blocks.

For delegators, this level of consistency translates into maximized reward potential, as effective leader slot execution is crucial for maintaining optimal staking returns. Starke Finance's continued excellence in block production confirms our commitment to delivering dependable, high-performance validation for our community.

Source: JPool

Uptime (30 days)

Starke Finance achieved a flawless 100% uptime over the past 30 days, guaranteeing uninterrupted participation in Solana's consensus and block production processes. This perfect performance highlights the robustness of our infrastructure and our ongoing commitment to operational excellence, ensuring delegators benefit from consistent reward generation and seamless network reliability.

Backed by proactive monitoring, redundant systems, and a performance-first operational strategy, Starke Finance continues to deliver a secure, dependable, and high-performing environment, one where your stake operates with maximum efficiency, confidence, and stability around the clock.

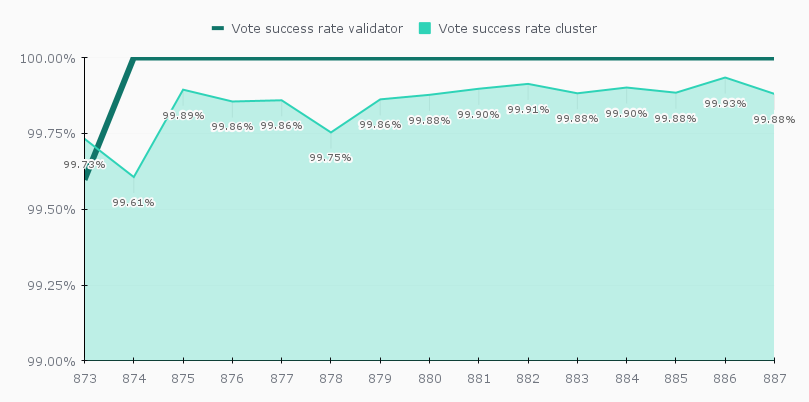

Vote Success Rate

Over the past month, Starke Finance delivered an exceptional vote success rate, achieving 100% accuracy in 14 out of 15 epochs. The only slight deviation occurred in epoch 873, where the validator registered a still-strong 99.6% result. All remaining epochs reached a perfect 100%, demonstrating consistent and highly reliable participation in Solana's consensus process.

During this period, the cluster average ranged between 99.6% and 99.9%, placing Starke Finance firmly above or fully aligned with network-wide performance throughout nearly all epochs. This consistency reinforces our validator's reliability and precision in confirming votes and contributing to secure block finalization.

Such unwavering accuracy ensures that each vote contributes effectively to consensus and reward generation, strengthening both delegator returns and the overall integrity of the Solana network.

Source: Solana Beach

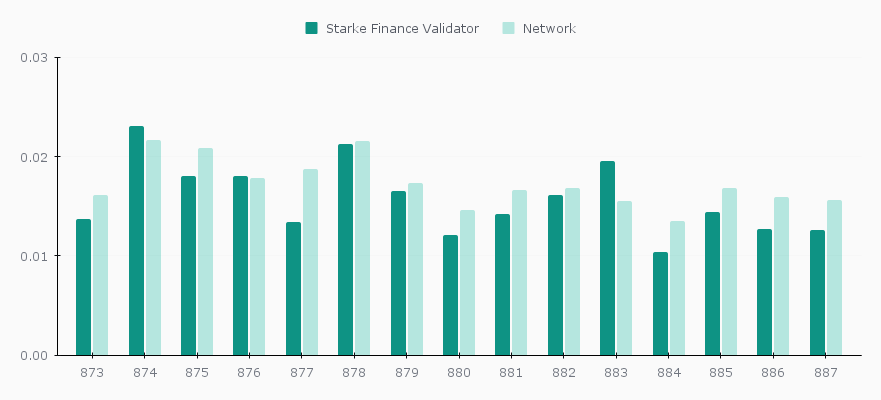

Average Block Reward (SOL)

Across epochs 873-887, Starke Finance maintained stable and competitive block rewards, averaging results closely aligned with network conditions. During this period, our validator's block rewards ranged between 0.0104 and 0.0231 SOL, while the cluster average moved between 0.0135 and 0.0217 SOL. Despite the natural variability inherent to Solana's block production cycles, Starke Finance continued to deliver consistent and reliable reward generation.

While some epochs came in slightly below the cluster average and others exceeded it, our overall performance remained solidly within the upper tier of the network's validators. This balance reflects the effectiveness of our node configuration, steady block production, and ongoing optimization efforts.

As network dynamics evolve, Starke Finance remains focused on maximizing real yield for delegators through operational precision and sustained infrastructure excellence, ensuring that every produced block contributes to strong staking rewards.

Source: SolanaCompass

Staking & Market Share

This section offers a detailed snapshot of Starke Finance's staking performance and validator presence throughout November. It highlights key indicators such as stake growth, market share evolution, delegator distribution, epoch-to-epoch stake movements, and overall stake account activity. Together, these metrics illustrate how Starke Finance continues to solidify its role within the Solana ecosystem, showing consistent operational strength, reliable returns, and a steadily growing base of delegators, all contributing to the long-term resilience and independence of our validator.

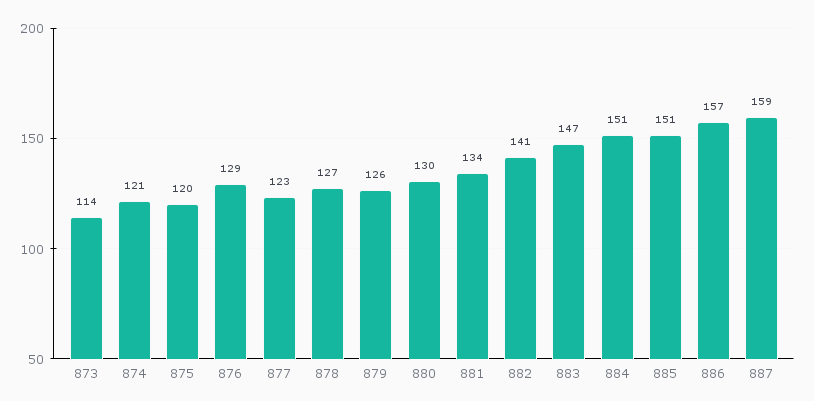

Stake Accounts

During November, the number of stake accounts delegated to Starke Finance showed steady and consistent growth. Beginning the period with 114 accounts in epoch 873 and reaching 159 by epoch 887, this upward trend reflects increasing engagement from individual delegators and a gradual broadening of our staking base.

Rather than large, abrupt changes, this month's progression illustrates healthy organic expansion, with new delegators joining and existing ones maintaining their commitment. This continued rise in stake account activity underscores the trust placed in our validator's performance, transparency, and long-term reliability.

Source: Solana Beach

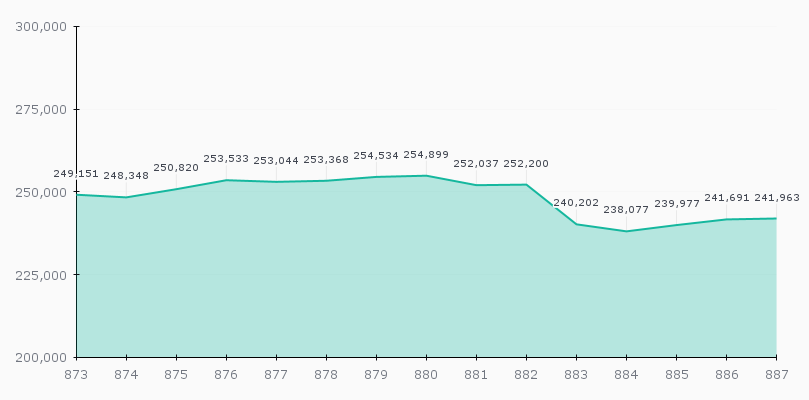

Total SOL Staked

Throughout November, the total stake delegated to Starke Finance experienced a moderate decline, decreasing from 249,151 SOL at the start of the period to 241,963 SOL by epoch 887, a 4.14% monthly reduction. This shift was driven mainly by the widespread decrease in the Solana Foundation Delegation Program, which has been gradually reducing its delegated stake across all validators and will continue to do so until approximately epoch 893. As this temporary adjustment affects nearly every validator, the reduction reflects a network-wide trend rather than any performance-related factors, contributing to the broader decline in delegated SOL across the cluster.

Despite this temporary contraction, independent delegations have remained steady, and Starke Finance continues to benefit from a strong base of long-term supporters. This phase represents a natural part of Solana's evolving delegation landscape, and our validator remains well-positioned, supported by solid community trust, consistent operational performance, and an APY that continues to outperform the network average.

Source: Stakewiz

Stake Market Share

As of the end of November, Starke Finance continues to represent approximately 0.06% of all SOL staked across the Solana network and 0.07% of the SOL staked through native (non-liquid) staking. While these percentages remain modest, they reflect a stable and reliable position within a large and highly competitive validator landscape

Looking forward, we remain committed to growing our organic delegations and strengthening our footprint within the network. With the upcoming launch of our managed tokenized fund service, we anticipate new opportunities to expand our stake share while upholding the high standards of performance, transparency, and operational resilience that define Starke Finance

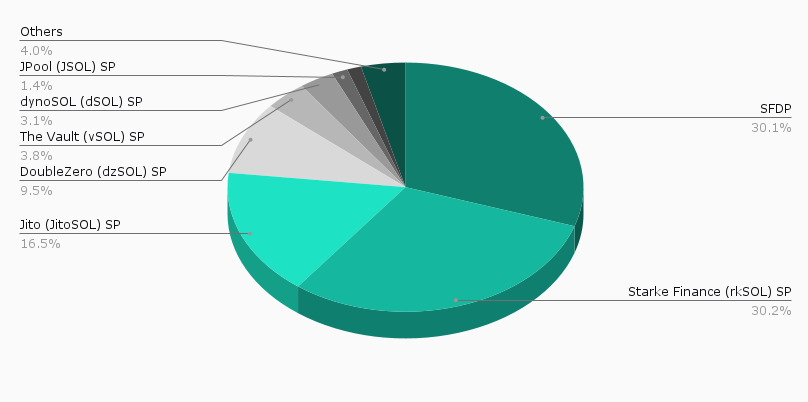

Active SOL Stake Distribution by Delegator

As of the end of November, Starke Finance's active stake stood at 242,116 SOL, reflecting a well-balanced distribution across institutional partners, staking pools, and independent delegators. The Solana Foundation Delegation Program (SFDP) remains a key contributor, representing 30.07% of the total active stake, closely followed by rkSOL, Starke Finance's own liquid staking pool, with 30.24%. Other significant contributors include Jito (16.52%), DoubleZero (9.46%), The Vault (3.80%), dynoSOL (3.15%), JPool (1.45%), and Edgevana (1.29%), supported by a broad mix of independent delegators and several stake pools contributing smaller amounts, together representing 4.03% of the total stake.

This distribution highlights a healthy diversification of staking sources and a strong foundation of institutional relationships, complemented by ongoing support from community delegators. Together, these contributors demonstrate sustained confidence in Starke Finance's performance, transparency, and reliability within the Solana validator ecosystem.

Source: Solscan

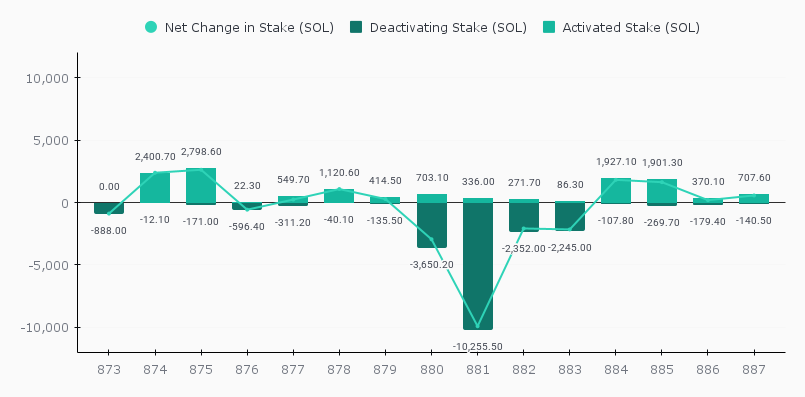

Net Change in Stake

Stake movements across epochs 873-887 reflect another month of shifting dynamics within the Solana staking ecosystem, resulting in a total net outflow of approximately -7,745 SOL. Although the period included several moderate inflows that added healthy balance to our stake, these were ultimately outweighed by a series of larger deactivations mid-month. A single significant withdrawal contributed heavily to the overall decline, shaping the month's net negative position.

These stake reductions align with the ongoing decrease in allocations from the Solana Foundation Delegation Program, which continues to scale down validator-wide stake and will do so until approximately epoch 893. As a result, the net outflow seen this month mirrors a broader cluster-wide trend rather than validator-specific performance concerns.

Despite these temporary shifts, Starke Finance continues to maintain a solid foundation of long-term delegators and organic support. The mix of steady inflows alongside periodic program-driven deactivations demonstrates our validator's resilience and the continued confidence placed in our operations within the evolving delegation landscape of the Solana ecosystem.

Source: SolanaCompass

Maximize your Solana rewards with Starke Finance

Starke Finance provides a next-generation staking experience designed for both institutional and individual participants who want to earn more from their Solana (SOL) holdings. Our mission is to make staking simple, transparent, and rewarding - offering direct access to high-performance validation with zero complexity.

Through non-custodial staking, you always maintain full control of your assets while benefiting from enterprise-grade infrastructure, optimized uptime, and secure reward distribution. Our validator is built to maximize real yield through efficient performance, seamless operation, and fair reward structures.

When staking with Starke Finance, you can expect:

- Higher yield potential: our infrastructure is optimized to capture every possible reward, including Jito MEV returns.

- Zero fees: 0% validator commission - you keep 100% of your earned SOL.

- Transparency & control: track your rewards at any time.

- Reliable Infrastructure: professionally operated systems built for speed, security, and consistency.

Whether you're a seasoned investor or a new participant in the Solana ecosystem, Starke Finance delivers the performance, transparency, and confidence you need to grow your stake securely.

Stake with Starke Finance - earn more, stay in control, and be part of a validator built for the future of Solana.

Disclaimer

This report has been prepared by Starke Finance to provide transparency and insight into the performance of its Solana validator. The information presented is for informational and educational purposes only and should not be considered as financial, investment, legal, or tax advice. While all data and metrics are derived from reliable sources and on-chain analytics, Starke Finance makes no representations or warranties regarding the accuracy, completeness, or future reliability of this information. Validator performance, rewards, and staking yields are subject to change based on network conditions and protocol updates. Readers and delegators are encouraged to conduct their own due diligence before making staking or investment decisions.

Contributors

Ana CabaleiroFinancial Analyst