Research

Starke Finance rkSOL Report - November 2025

November brought lower rkSOL prices and liquidity due to ecosystem-wide turbulence, but core metrics, staked SOL, APY, and holder activity, held steady. rkSOL continued to demonstrate stability and reliability even as market conditions softened.

Download the PDF

Estimated Reading Time: 8 minutes

Summary

In November, rkSOL reflected the broader downturn across the Solana ecosystem, entering a month defined by declining market metrics but stable protocol fundamentals. Price, market capitalization, and liquidity all contracted meaningfully, largely driven by SOL's pronounced pullback rather than changes in rkSOL's underlying mechanics. Despite these pressures, core indicators such as circulating supply, APY performance, total SOL staked, and user participation remained steady, demonstrating resilience amid a challenging market environment. With staking balances gradually increasing and market share holding firm, rkSOL continued to function as a dependable liquid staking option, maintaining consistent engagement and utility even as broader conditions softened

Quick Facts

Starke Staked SOL (rkSOL) is a liquid staking token (LST) on the Solana blockchain, launched on May 29, 2024. It represents SOL staked with our Starke Finance validator, allowing holders to earn staking rewards while keeping their assets liquid.

Instead of locking SOL in a traditional stake, users hold rkSOL, a token that mirrors the value of their underlying staked SOL and accrues rewards over time. This structure enables participation in network validation and yield generation without restricting access to funds, making rkSOL a staking alternative that also allows participation in DeFi protocols.

Token contract: EPCz5LK372vmvCkZH3HgSuGNKACJJwwxsofW6fypCPZL

Source: Starke Finance (as of December 4, 2025)

Market & Growth Overview

This section analyzes rkSOL's market structure and growth metrics for November, such as supply, market capitalization, price, liquidity, net inflow, and holders. It provides insight into the protocol's stability, activity trends, and its response to broader movements within the Solana ecosystem.

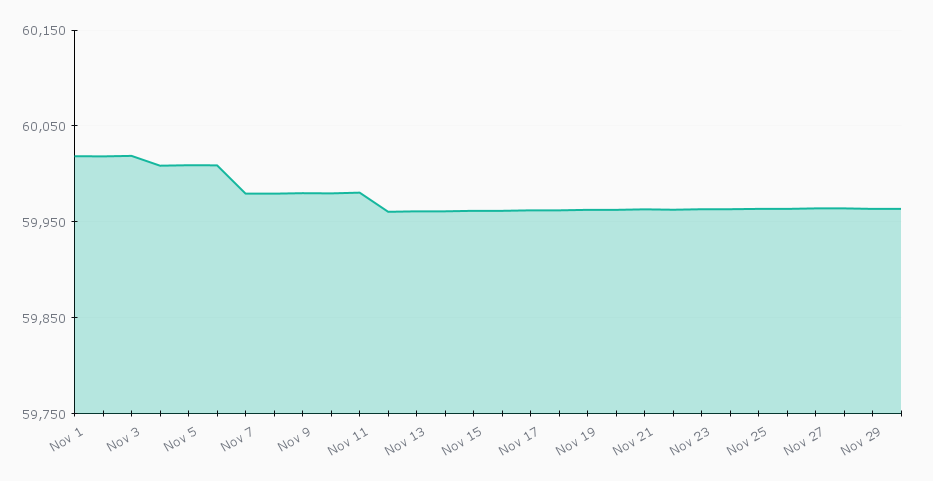

Circulating Supply

The circulating supply of rkSOL remained broadly stable throughout November, moving only marginally from 60,018.50 tokens on November 1 to 59,963.57 tokens by November 30, a modest monthly decline of approximately 0.09%.

Unlike October, which saw sharp fluctuations driven by large unstaking events, November was characterized by low volatility and gradual micro-adjustments. The most notable movement occurred in the first week of the month, when supply briefly dipped below 60,000 tokens on November 7-8, reflecting minor repositioning among stake holders rather than any structural shift.

Following this brief softening, circulating supply hovered consistently around 59,960-59,965 tokens for the remainder of the month. This narrow trading band indicates a period of equilibrium in staking behavior, with participant allocations largely settled and validator yields exerting minimal influence on distribution patterns.

Source: Solscan

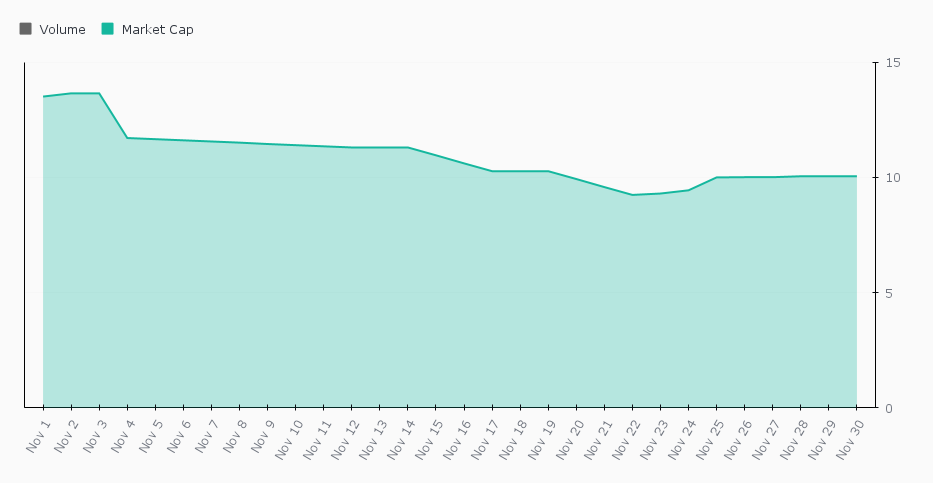

Market Capitalization & Volume

The market capitalization of rkSOL contracted significantly throughout November, declining 22.99% from $13.51 million on November 1 to $10.05 million by month-end. The first few days of November saw relatively stable valuations near $13.6 million, but a sharp decline emerged on November 4, when market cap dropped from $13.65 million to $11.71 million. This early-month adjustment marked the beginning of a sustained downtrend rather than a single isolated event.

Following this initial drop, rkSOL's market capitalization continued to ease lower in a steady, incremental pattern, driven primarily by the broader decline in SOL's price rather than changes in rkSOL supply or demand. By November 21-22, valuations reached a monthly low near $9.24 million before a modest recovery lifted rkSOL back to the $10 million range during the final week of the month. This late-month stabilization suggests that the downward pressure began to abate as SOL's price found a short-term footing, allowing rkSOL's valuation to consolidate alongside broader ecosystem conditions.

Trading volumes throughout November were generally subdued, with prolonged stretches of near-zero activity highlighting muted market participation.

Source: birdeye (Data in USD millions)

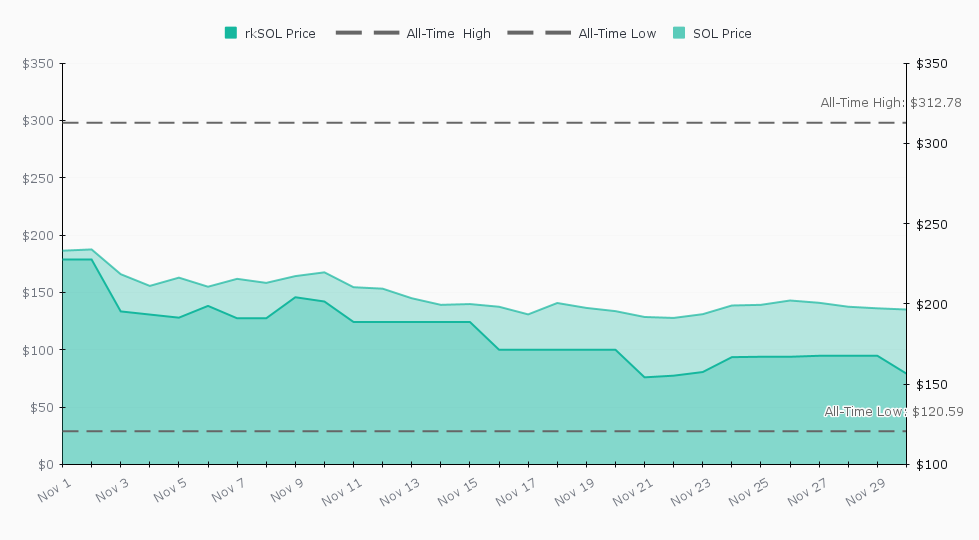

Price

The price of rkSOL declined sharply in November, falling 30.47% from $227.59 on November 1 to $156.49 on November 30. After a steady start to the month, rkSOL entered a broad downtrend beginning on November 3, mirroring the pronounced weakening of SOL across the same period.

Throughout the month, SOL retreated from $186.34 to $135.04, driving much of rkSOL's price movement. The pair remained tightly correlated, reflecting the structural relationship between the token and its underlying asset. Despite the drawdown, rkSOL remained well above its all-time low of $120.59, set earlier in April, though notably below its all-time high of $312.78 reached just one month earlier on September 18.

The premium of rkSOL over SOL stayed compressed during November, influenced by network-wide yield softening and the continued impact of Sanctum's 2.5% fee on liquid staking rewards. These dynamics slightly reduced effective yields for holders, contributing to a narrower spread relative to SOL.

By the end of the month, rkSOL had stabilized within the $155-$170 range, recovering modestly from its monthly low of $154.20 on November 21-22.

Source: Solscan, Starke Finance

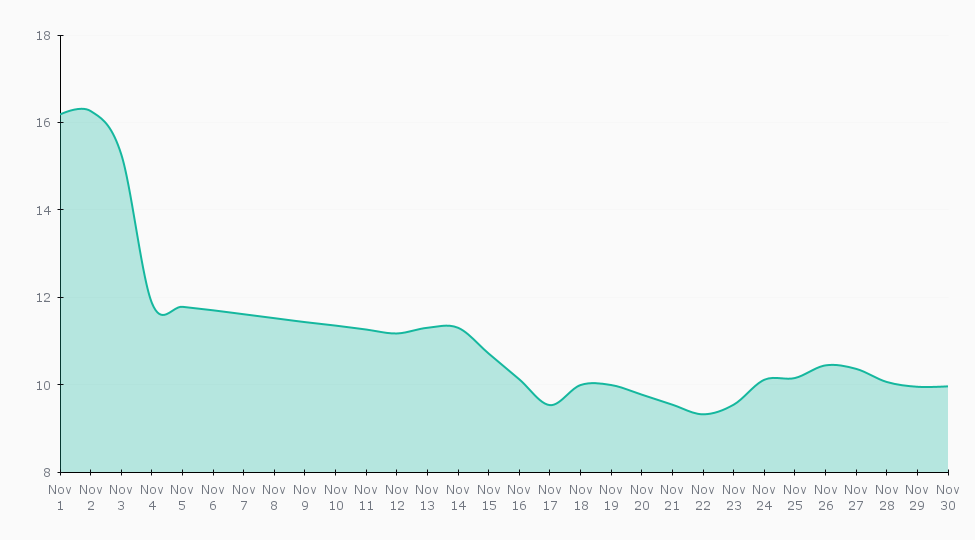

Liquidity

Liquidity continued to weaken throughout November, declining from $16.18 million on November 1 to $9.96 million by month-end-an overall contraction of roughly 38%. After a relatively stable start during the first two days of the month, liquidity dropped sharply on November 3-4, falling from $15.27 million to $11.87 million as market conditions deteriorated and SOL's price experienced significant volatility.

Following this early decline, liquidity continued to tighten gradually throughout the month, reaching a low of $9.32 million on November 22 amid continued market softness. In the final week of November, conditions improved modestly, with liquidity rebounding back above $10 million and stabilizing around the $10 million mark through November 30.

Source: birdeye (Data in USD millions)

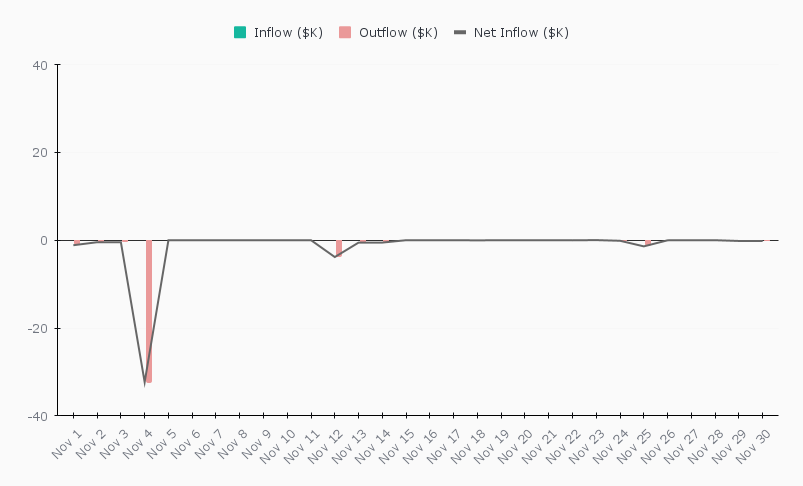

Net Inflow

rkSOL's net inflow activity in November was markedly subdued, with the month dominated by small but persistent outflows. The period opened with immediate redemptions on November 1-3, totaling just over $2K in net outflows and setting the tone for steady participant withdrawals rather than new capital entering the ecosystem. The most significant movement occurred on November 4, when rkSOL recorded a sharp net outflow of $32.31K, the largest single-day shift of the month. Activity remained minimal afterward, with long stretches of zero inflows or outflows and only small mid-month redemptions, including -$3.83K on November 12 and -$0.54K on November 13-14.

Late November saw a few scattered inflows, most notably on November 22 and 24, but these modest additions were outweighed by continued redemptions, including a late-month outflow of $1.4K on November 25. By November 30, total net inflows stood at -$41.20K, reflecting continued cautious sentiment and gradual exposure reduction throughout the month.

Source: birdeye (Data in USD thousands)

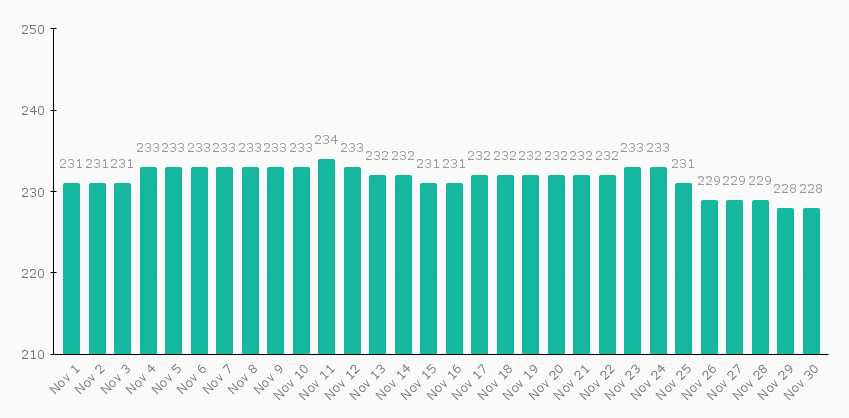

Holders

The number of rkSOL holders saw a slight decline during November, edging down from 231 on November 1 to 228 on November 30, representing a modest 1.3% month-over-month decrease. Activity remained largely stable through the first half of the month, with holder counts fluctuating narrowly between 231 and 234. A brief uptick occurred on November 11, when the number of addresses reached a monthly high of 234, before gradually trending lower in subsequent days.

Mid- to late-month movement showed mild attrition in the holder base, with a steady reduction beginning on November 25 and continuing through month-end, where counts settled at 228. These shifts appear to reflect routine position adjustments rather than any structural disengagement, particularly given the relatively low volatility in holder numbers throughout most of the month.

Overall, rkSOL's holder base remained stable despite November's broader market weakness. The minimal month-over-month change suggests that participation in the asset continues to be resilient, with only limited churn among addresses even as liquidity, prices, and inflows softened across the ecosystem.

Source: Solscan

Performance

This section reviews rkSOL's performance over recent epochs, focusing on its annual percentage yield (APY) and how it evolved in relation to network-wide staking trends.

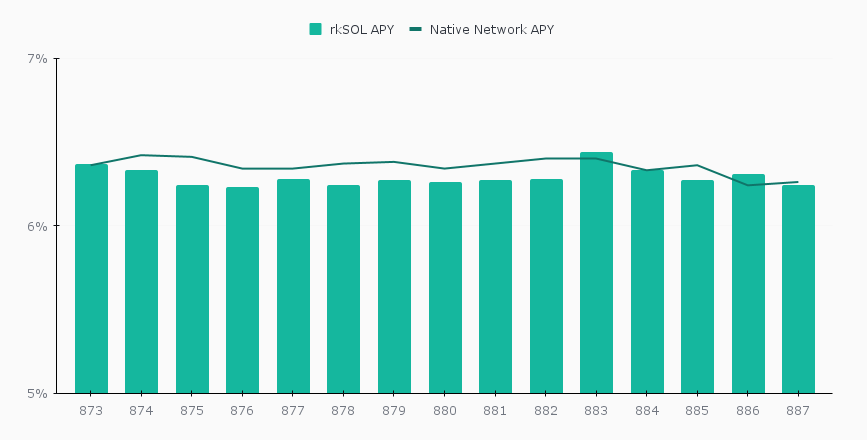

APY

During November 2025 (epochs 873-887), rkSOL's APY continued to track closely with the Solana network's native staking yield, averaging 6.29%, compared to the network average of 6.35%. Throughout the period, rkSOL's APY ranged from 6.23% to 6.44%, while the network APY fluctuated between 6.24% and 6.42%, reflecting a consistently narrow spread between the two. As in prior months, rkSOL's slightly lower effective yield can be attributed to Sanctum's 2.5% fee on liquid staking rewards, which modestly reduces net returns relative to the validator's gross performance. This effect remained subtle but persistent, contributing to the average -0.06% differential observed during the month.

Despite this small adjustment, rkSOL continues to offer a compelling value proposition for stakers, pairing competitive yields with the added advantages of instant liquidity and greater utility across the Solana DeFi landscape.

Source: Sanctum, Blockworks APY based on a 10-epoch average

Defi Integration

This section analyzes the evolution of rkSOL's Total Value Locked (TVL) throughout November. It examines changes in the amount of assets staked in the protocol, providing insight into liquidity dynamics, user participation, and the overall scale of adoption of our liquid staking solution.

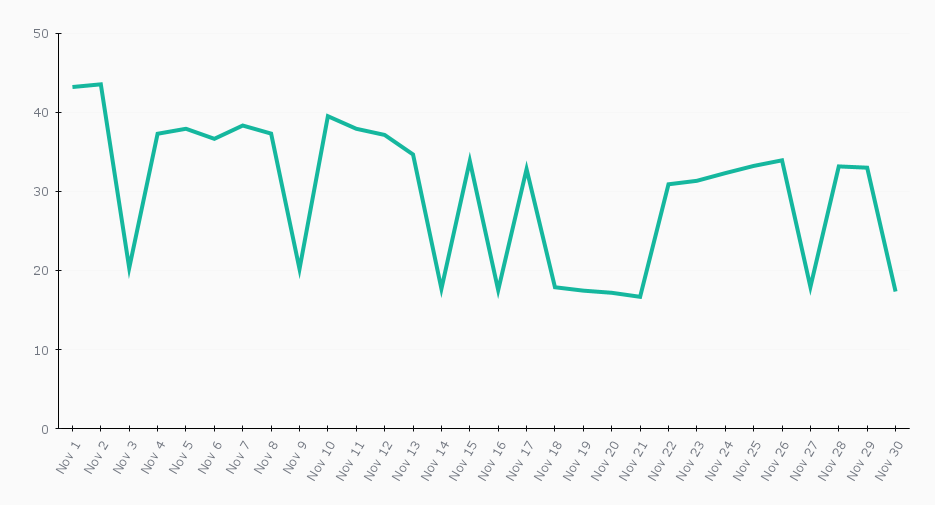

Total Value Locked (TVL)

During November 2025, rkSOL's Total Value Locked (TVL) continued to exhibit the low-range fluctuations established after October's recalibration. The month began with values around $43, but a drop on November 3 to $20.31 signaled the return to the narrower TVL band that has characterized recent reporting. From that point forward, daily TVL oscillated primarily between $17 and $40, with several alternating dips and recoveries, including lows near $16-18 on November 14-16 and November 20-21, and brief rebounds back above $30 in the latter part of the month.

Despite these fluctuations, the pattern reflects a consistent and relatively stable liquidity footprint for rkSOL under the updated measurement regime. The repeated transitions between the lower ($16-20) and mid ($30-40) bands suggest normal day-to-day variability rather than structural shifts in utilization or inflows.

Source: Solscan

Staking & Market Share

This section examines rkSOL's position within the Solana staking ecosystem, focusing on its share of total and liquid-staked SOL while examining how the amount staked evolved over the past month.

Total SOL Staked

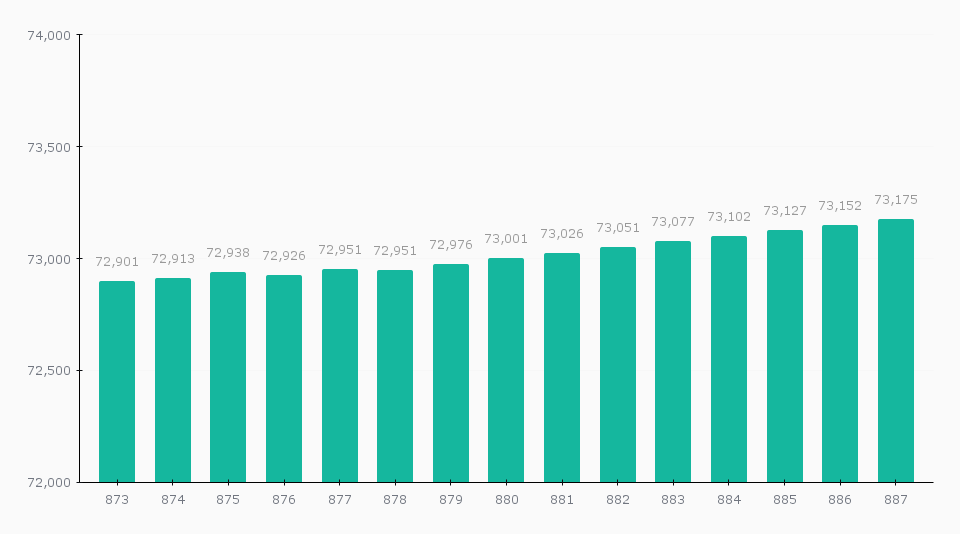

During November 2025 (epochs 873-887), rkSOL's total staked balance increased modestly from 72,901 SOL to 73,175 SOL, reflecting a 0.41% month-over-month rise. This upward movement indicates a period of steady staking participation, with balances climbing gradually across epochs and showing no signs of significant volatility. The consistent progression, from early-month levels just below 73,000 SOL to mid- and late-month highs above 73,150 SOL, suggests stable delegator engagement and continued trust in rkSOL's staking mechanics.

Importantly, the incremental growth in staked SOL supports the view that participants maintained confidence in the asset despite broader market softness observed during the month.

Source: Blockworks, Solana Compass

Market Share

By the end of November, rkSOL's position within Solana's staking landscape remained steady, continuing to account for approximately 0.02% of all SOL staked on the network. Within the liquid staking segment, rkSOL represented 0.12% of total SOL staked through LSTs, reflecting a slight proportional adjustment but still broadly consistent with prior-month levels. These figures indicate that rkSOL remains in the early stages of adoption, yet the stability of its market share highlights a committed user base and ongoing protocol engagement.

As integrations expand and visibility within the ecosystem continues to grow, rkSOL is well positioned to build on this foundation. Maintaining a stable share during periods of broader market volatility reinforces its resilience and suggests room for gradual long-term expansion within both Solana's overall staking environment and the competitive LST market.

Earn More, Stay Liquid with rkSOL

rkSOL is Starke Finance's liquid staking solution, designed to help you earn staking rewards while keeping your SOL fully liquid. It combines accessibility, efficiency, and performance, allowing you to participate in staking without locking your assets.

With rkSOL, your tokens continue to generate yield while remaining available for use across the Solana ecosystem, from trading and lending to participating in DeFi opportunities. Built on Starke Finance's high-performance infrastructure, rkSOL offers a seamless and transparent way to maximize your returns.

When holding rkSOL, you benefit from:

- Continuous yield: earn passive returns without locking your capital.

- Full flexibility: move, trade, or use rkSOL across DeFi protocols at any time.

- Simplicity: one token, continuously increasing in value through accrued yield.

- Transparency: easily monitor rkSOL's performance and value growth.

rkSOL empowers you to stay liquid, earn efficiently, and remain an active participant in the Solana ecosystem, all while enjoying the security and reliability of Starke Finance.

Stake smarter. Stay liquid. Choose rkSOL.

Disclaimer

This report has been prepared by Starke Finance to provide transparency and insight into the performance of its rkSOL token. The information presented is for informational and educational purposes only and should not be considered financial, investment, legal, or tax advice. Although all data and metrics are derived from reliable sources and on-chain analytics, Starke Finance makes no representations or warranties regarding the accuracy, completeness, or future reliability of this information. rkSOL's yield is subject to change based on network conditions and protocol updates. Readers and participants are encouraged to conduct their own due diligence before engaging in liquid staking or related activities.

Contributors

Ana CabaleiroFinancial Analyst