Guides

Solana Staking Yield: How Much Can You Earn?

Staking on Solana remains a strong source of passive income as yields stabilize. Long-term compounding and smart validator choices drive consistent returns.

Estimated Read Time: 7 minutes

As of October 2025, Solana continues to offer appealing returns for holders who stake their SOL tokens. With careful selection of validators, SOL holders can realize significant passive income while maintaining network security and maximizing staking efficiency. This guide provides:

- A snapshot of current yields;

- The relationship between staking participation and returns; and

- The power of compounding rewards.

Quick Overview: How Solana Staking Rewards Work

- Monetary policy: Inflation rate began at 8% and fell 15% annually until a 1.5% floor; the new SOL is the reward pool.

- Yield formula: User APY = Inflation Rate × (1 - Validator Fee) × (1 ÷ % of SOL Staked) × Validator Uptime.

- Validator commission: Many operators charge 5-10%, skimmed before rewards reach you.

- Network participation: About 67.31% of the total supply is staked, so the reward pie is divided among many participants.

- Auto-compounding: Rewards drop into the same stake account every epoch, instantly earning on the next round with no manual "restake" clicks required.

- Long-run glide-path: If staking remains ~75% of supply, yields are expected to converge toward roughly 2% APY once inflation rate hits its floor.

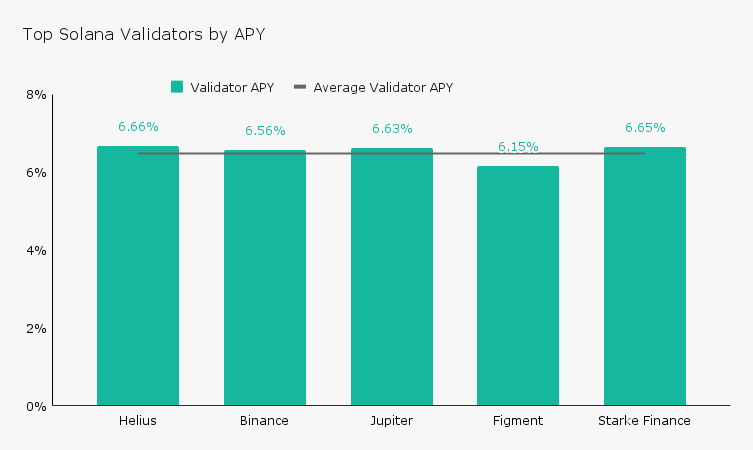

Solana Staking Yield Snapshot (As of October 18, 2025)

To begin, let's examine current staking yields across various platforms and validators:

Starke Finance currently offers an APY slightly above the Solana staking network average of 6.48%, placing it among the higher-yielding validators alongside major operators such as Helius, Binance, and Jupiter. This shows that validator size doesn't always correlate directly with performance, and opportunities for attractive returns can also be found among emerging or less superminority operators.

Beyond the graph, there are a few additional insights:

| Convenience Still Sells |

|---|

| Whether due to lack of awareness or a lack of desire for risk, major exchanges still see large numbers of stakers opt for their offerings, even with the typically lower yields due to higher fees and premiums. |

| Consistency Pays Off for Smart Stakers, Too |

|---|

| Over time, staking with a validator that delivers consistent performance and maintains fair or even zero fees can provide steady, reliable rewards, often outweighing the marginal benefits of constantly redelegating to chase slightly higher APYs. |

| Another Investing Truism Holds Up |

|---|

| Higher staking returns can be appealing, but people should understand the factors that drive those increased yields. We've previously written on liquid vs. native staking here. |

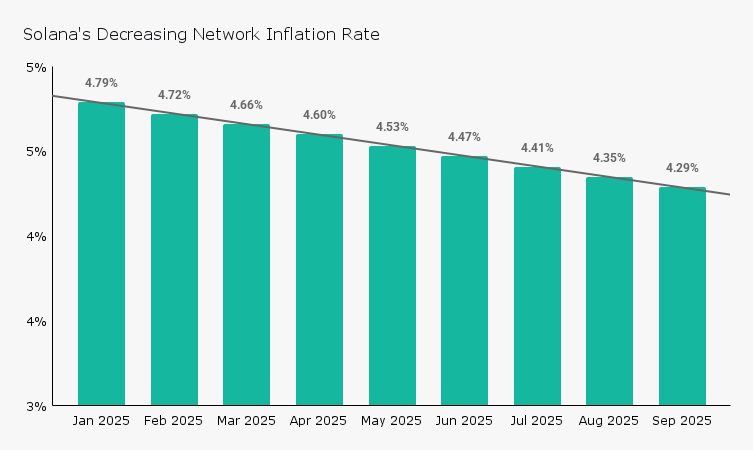

Solana Network Inflation Rate (Jan-Sep 2025)

While there are proposals to limit it, the overall pace of inflation rate of Solana is set to drop, from an initial rate of 8% when launched, to just 1.5% in 2030. As will be seen later, this creates an environment where the currency has seen steady adoption and a substantial staking rate of 67.31% as of October 18, 2025. However, without built-in growth levers or stability mechanisms, the network experiences a gradual decline in its inflation rate, as seen below:

As the inflation rate drops, savvy investors are watching as staking validators consolidate, as well as tracking liquid staking options that provide more flexibility, but also more risk. Absent a major change in monetary policy, Solana staking using the traditional native methods appears to have a finite asymptote of rewards in the coming years. Investors will need to be mindful of this and their risk profile as they consider their investments within the currency and broader markets.

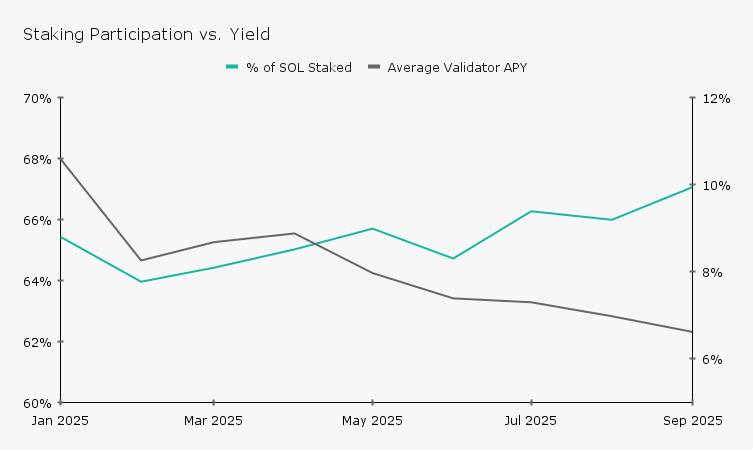

Staking Participation vs. Yield (Jan-Sep 2025)

The inverse correlation between staking participation and yields is highlighted by the year-to-date data:

Understanding Participation Dynamics

- Rising Participation: As more SOL is staked, rewards per token naturally decrease, leading to a slight yield decline.

- Yield Sensitivity: Even small percentage changes in participation can impact yields, emphasizing the need for continual monitoring.

- Investor Implications: Savvy investors may benefit from strategically timing their staking and considering liquid staking solutions, which can offer greater flexibility to manage yield fluctuations. The ability to avoid the ~2-day cooling-off periods can enable more timely adjustments and optimized participation.

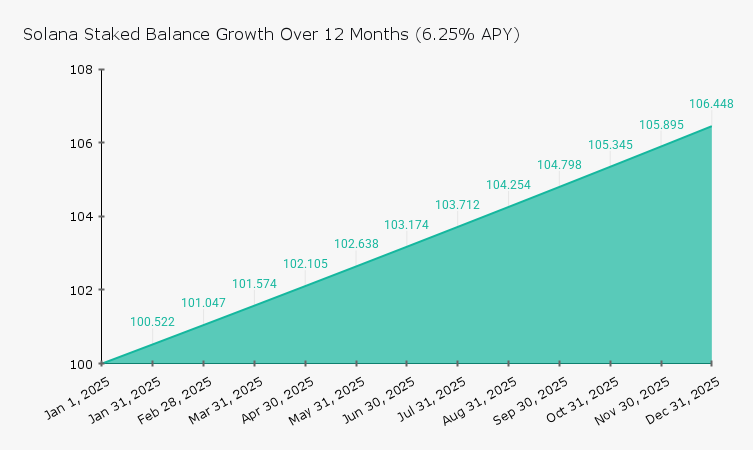

Compound Growth of 100 SOL Staked in 2025 (at constant 6.25% APY)

Lastly, observe how compounding (when rewards are actively restaked) can significantly impact staking returns over one year:

Leveraging the Power of Compounding

Regular Reward Accumulation

Regular rewards are distributed approximately every epoch (generally less than two days), but must be manually restaked or auto-compounded through supported tools, to steadily increase total SOL holdings, and achieve exponential growth over time

Long-Term Benefits

Long-term investors particularly benefit from the compound effect where rewards are automatically staked, significantly boosting their SOL holdings and overall investment value.

Predictable Returns

While yields fluctuate slightly month-to-month, consistent staking and reinvestment ensures predictable long-term growth, providing reliable passive income despite market changes.

Validator & Platform Playbook

Each staking approach involves different trade-offs between convenience, control, and earning potential. This comparison breaks down the key operational differences between staking methods to help you pick the right approach for your situation.

| Dimension | Direct Validator Staking | Liquid Staking | Exchange Staking |

|---|---|---|---|

| Delegation Method | Direct to chosen validator via wallet or CLI (Command line Interface) | Routed via DEX aggregators (e.g., Titan, Jupiter) | Custodial service through exchange account |

| Custody Model | Self-custodied SOL remains under your wallet control (minus lockup window) | Protocol holds SOL; you receive liquid tokens (e.g., mSOL, rkSOL, JitoSOL) | Exchange holds your SOL |

| Redemption Latency | ~2 day unlock period per Solana protocol | Immediate exit by swapping liquid token (subject to slippage/liquidity) | No technical lockup unless imposed by the exchange |

| Validator Selection | You research and choose specific validator | Depends on the protocol, it can be a stake pool of multiple validators with a adhoc delegation criteria (mSOL, JitoSOL etc) or single validator Liquid stake tokens (rkSOL, hSOL etc) | Exchange manages validator selection |

| Commission Structure | Validator commission, typically 0-10% | Built into protocol fee. Varies by provider but typically 3-10% | Exchange fee structure (often highest) |

| MEV Participation | Available only with MEV-enabled validators | Depends if the protocol delegates to MEV-enabled validators | Typically not shared with users |

| DeFi Integration | Stake can not be generally used as in DeFi | LSTs can enter DeFi protocols but depend on the listing criteria of each DeFi protocol. | No DeFi utility |

| Monitoring Required | Manual tracking of validator performance and uptime | Manual tracking in case LSTs performance changes criteria due to sharing into the LSTs additional revenue streams or stop doing it. | None required |

| Technical Knowledge | Moderate; requires validator research | Low; simple token swap | Minimal; account-based |

Practical Takeaways

Solana staking remains a robust passive income option in Q3-2025. Investors aiming to maximize their returns should carefully select validators, monitor staking participation trends, and harness the power of compounding rewards. By understanding the dynamics and strategically planning their approach, SOL holders can confidently benefit from sustainable and significant returns.

Sources:

Contributors

Ana CabaleiroFinancial Analyst